Your Optichannel Solution for Enhanced Sales and Customer Service

Empowering Growth Through Seamless Communication

LiveBank Platform powered by Ailleron

What is LiveBank?

LiveBank is a digital sales platform that enables customer interactions with financial institutions, enhancing and automating operations in branches and contact centers.

LiveBank Platform empowers bank customers with immediate access to advisors across branches and contact center, ensuring seamless customer experiences at every touchpoint, enabling:

- Smooth handoffs between channels

- Streamlined sales and customer service through Human-AI synergy

- Unified view and comprehensive data on customer engagement across all channels

- Extended Contact Center capabilities

The enterprise-class solution trusted by global banks

LiveBank in numbers

-

18

markets with successful implementations

owing to our experience in banking systems integrations

-

+450,000

interactions monthly via LiveBank

thanks to tapping into communication channels that bank clients prefer

-

+10,000

new bank accounts a month

established remotely using LiveBank eKYC processes

An enterprise-class communication & collaboration platform for banking.

Implementation technology tailored to your needs. Discover some of the benefits LiveBank offers to your bank.

- Customer support

- Sales

- Digital banking

- Optichannel

- IT

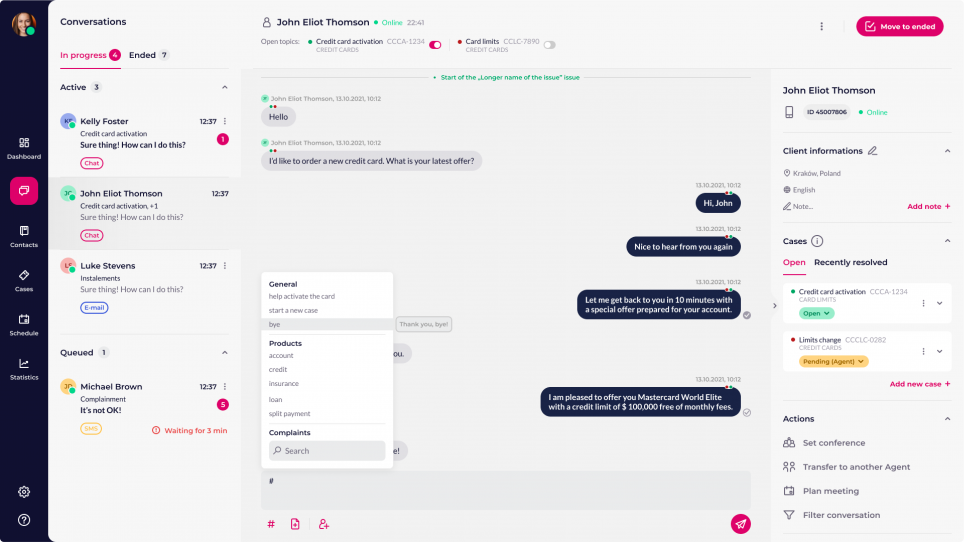

E-client support focused on solving problems and getting things done

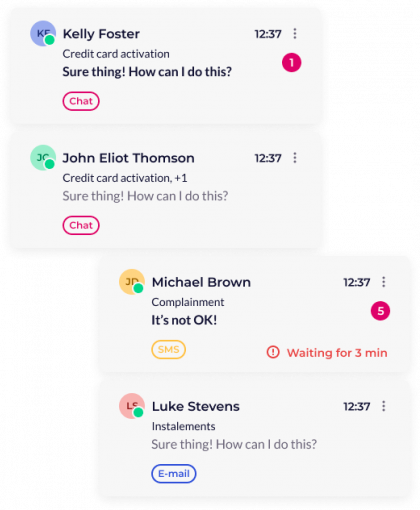

LiveBank streamlines banking processes and enhances customer support by providing real-time, human-to-human service over the communication channel of a client’s choice.

- single sign-on

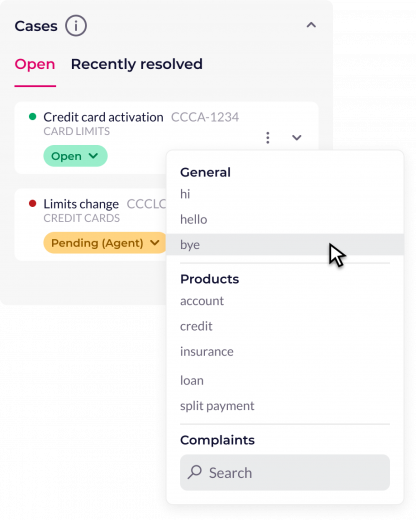

- case-based communication

Improved customer experience

- canned responses

- routing

- document repository

Optimisation of agents’ work and improved KPIs

Maximise sales results with existing resources

LiveBank frees up the sales team for selling, while remote communication with clients offers additional sales opportunities.

- eKYC

- e-signature

- ID verification

Easy onboarding process

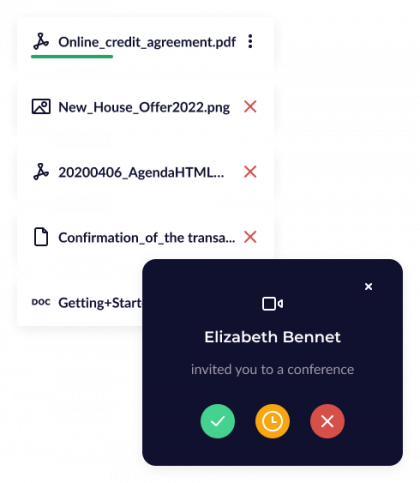

- file exchange

- co-browsing

- screen sharing

Support in clients acquisition

Migrate your clients to digital banking swimmingly

Staying ahead of the curve and providing modern, frictionless banking solutions with LiveBank is a way to improve client satisfaction and boost competitiveness in the marketplace.

- SaaS subscription model

- embed communication channels on demand

Quick time to market

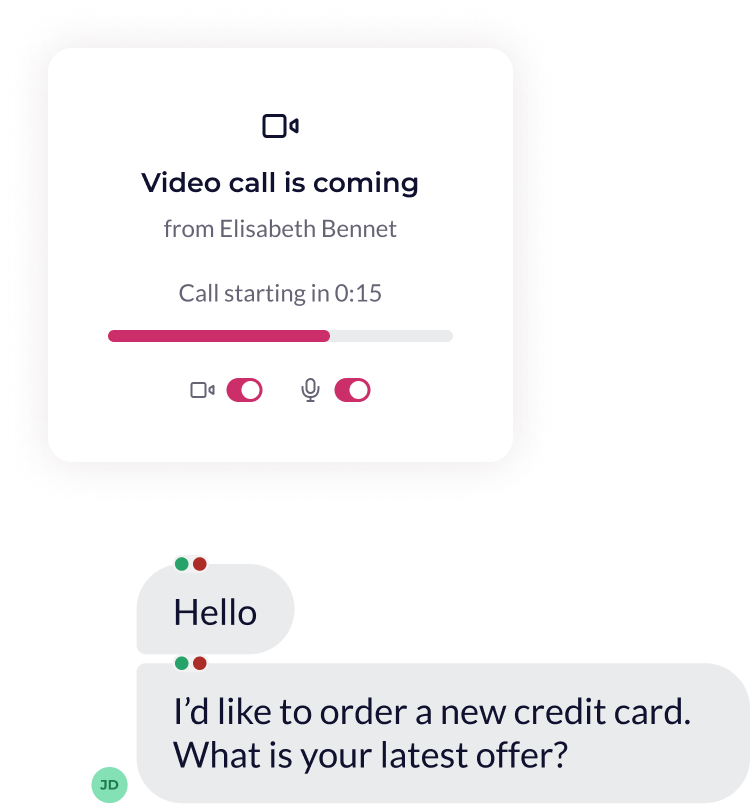

- chat and email

- audio and video calls

- social media messaging

Availability of bank services

Manage a multi-generation customer life cycle with an optichannel communication hub

LiveBank aggregates a multitude of communication channels in a single communication hub to respond to the needs of all generations and efficiently deal with clients’ matters.

- seamless switching between channels

- eKYC

- transaction authorisation

Convenience and

end-to-end customer support

- contact centers

- mobile and online banking

- bank’s back-end systems

One-point integration

Cloud transformation under the highest security standards

LiveBank was created specifically for and in cooperation with banks and has successfully undergone numerous bank security assessment processes. It ensures low-costs deployment and maintenance.

- SaaS cloud model

- open API

Immediate implementation

- message encryption

- biometrics

- recording and archiving interactions

Enterprise-class security standards

LiveBank supports your processes, not the other way around

LiveBank is a communication hub for banks that need a simple, fast, secure, and cost-effective system to manage a multi-generation customer life cycle using all available communication channels and optimise customer support performance at the same time.

-

Dev-friendliness

Open API, easy integrations, and seamless upgrade with ready-made modules

-

Cost management

Effective resource management to optimize customer support and increase sales

-

Banking class security

Cloud-based data processing and storage, encryption, and adherence to data protection law without slowing business