Virtual branch for online banking

Maximise sales results with existing resources

LiveBank

virtual branch

for banking

benefits

Boost Sales through Digital Customer Service

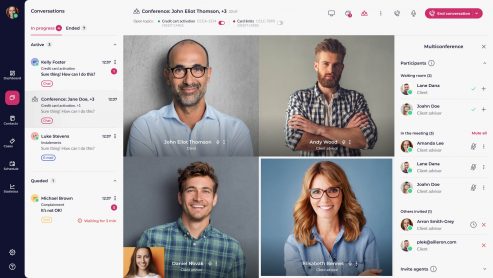

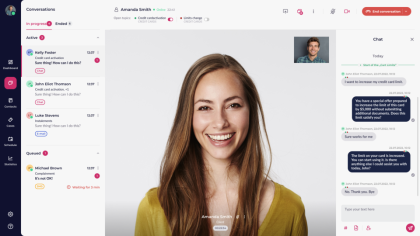

LiveBank goes beyond traditional chat interactions by providing agents with unparalleled visual context through screen sharing and co-browsing capabilities. This empowers agents to provide a level of personalized attention that rivals face-to-face interactions, allowing them to understand customer needs deeply and tailor sales pitches accordingly.

Boost Sales through Digital Customer ServiceIncrease conversion rates

Support your bank’s sales and upselling by making services available to prospects through voice or video calls, and messaging apps. Help your prospects become clients using collaboration tools such as screen sharing, co-browsing, and file exchange. With an outbound communication feature, LiveBank promotes a proactive approach to sales.

Increase conversion ratesStreamline the onboarding process

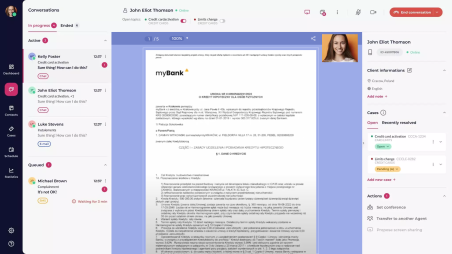

Streamlining the onboarding process is crucial for reducing churn rates and seizing sales opportunities. Enhance client acquisition and minimize onboarding duration by implementing efficient and secure ID verification through digital channels

Streamline the onboarding processSolve your problems with LiveBank’s virtual branch

How to increase the effectiveness of sales in digital channels?

Realise the full potential of sales in digital channels and support end-to-end processes.

How to proactively offer banking services and products to clients?

A proactive sales approach is a prerequisite for high conversion and achieving targeted KPIs. Use LiveBank to build close relations with your clients.

-

Increased revenue

recovery of lost sales

-

Cost efficiency

reduced client acquisition cost

-

Effective sales

increased lead conversion rate

Our clients say it best

Discover the LiveBank Interaction Platform in Action