eKYC in the Banking Sector – Streamline client onboarding process in compliance with regulations

Empower online sales with a reliable and user-friendly automated verification process that you can easily configure and integrate with your workflow.

Contact Sales

We would love to tell you more about LiveBank. Fill out the form, and we will get back to you shortly.

Types of eKYC systems

LiveBank provides the highest security standards to support your bank in maintaining compliance with legal regulations while decreasing onboarding time and cost.

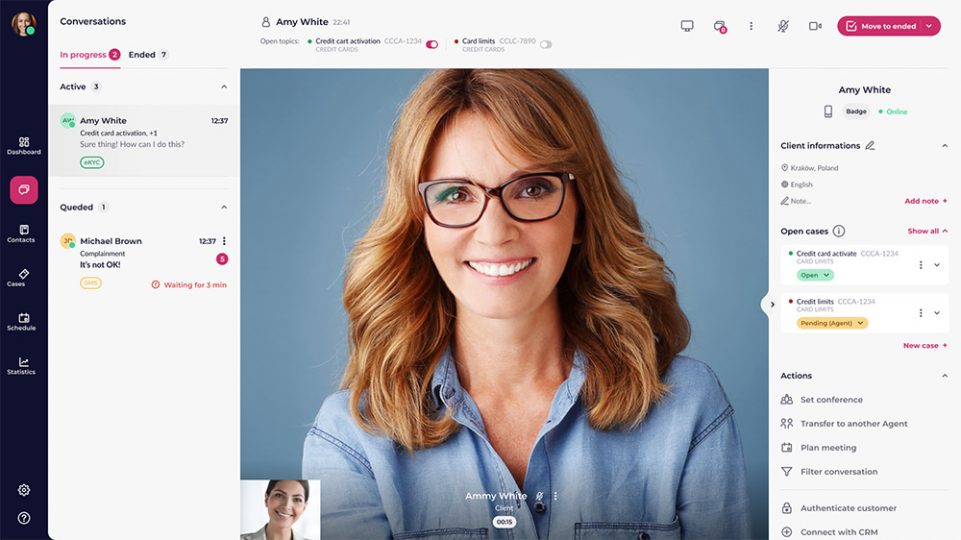

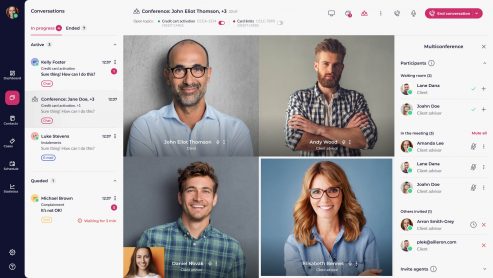

eKYC customer self service with human assistance

Discover seamless customer onboarding with the ‘eKYC Customer Self Service with Human Assistance’ film on LiveBank. Witness how your clients can effortlessly navigate the onboarding process with the aid of expert assistance, with a smooth and efficient experience. Watch a short movie.

eKYC customer self service

Explore effortless customer onboarding with our film on ‘eKYC Customer Self Service’. Witness how clients autonomously navigate the onboarding process, leveraging self-service tools without the need for direct assistance. Discover the benefits for banks as this efficient and secure approach enhances operational efficiency and reduces resource requirements, contributing to a more streamlined and cost-effective customer onboarding process. For more details, visit our page on customer onboarding process.

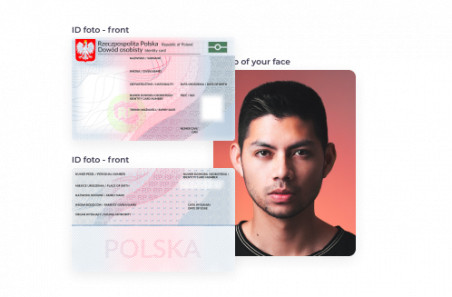

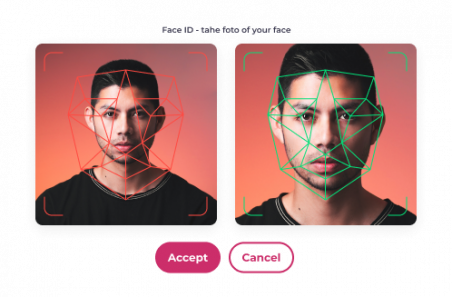

eKYC steps

Verify client identity and authenticate documents in a few simple steps. Discover further information on, How to do eKYC?

Integrations

LiveBank can be easily integrated with facial biometrics and ID verification components.

Our clients say it best

Test our solution or contact us to find out how LiveBank can help you

Contact us

We would love to tell you more about LiveBank. Fill out the form, and we will get back to you shortly.