Personal Banking Solutions LiveBank

conversational banking

conversational banking

LiveBank

conversational banking platform

benefits

Omnichannel approach

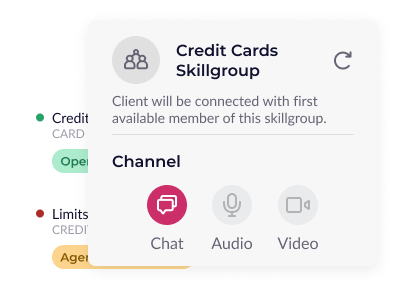

By incorporating different digital communication channels like live chat, audio and video call, email or messaging applications, you multiply the touchpoints in the customer journey. Each interaction becomes an opportunity to increase customer satisfaction, build trust and strengthen the relationships.

Omnichannel approachSynergy of human empathy and smart automation

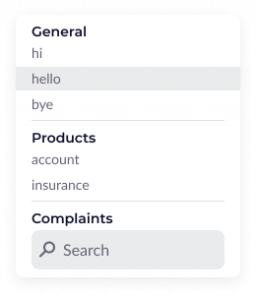

A customer journey that combines automated self-service and human assistance is highly flexible and reduces operational costs. This hybrid model meets the unique needs of each client. Case-based communication, canned responses, routing and collaboration tools enable more efficient communication and shorter resolution times.

Synergy of human empathy and smart automationPersonalisation and customer satisfaction

Clients want to feel valued, expect frictionless processes and need personalised service that addresses their individual needs. Aggregated history of interactions and consolidated client data enable a genuinely customer-centric approach that empowers agents to provide tailored advice and timely guidance.

Personalisation and customer satisfaction-

Meeting clients’ needs

51% of clients are not satisfied with the current form of communication with their banks

-

Convenience

80% of people prefer online banking over visiting a physical branch

-

Client retention

89% of clients are loyal to banks that implement an omnichannel strategy

How to effectively deal with complex client issues online?

Many simple questions can be answered with quick canned responses, and standard information can be conveyed by sharing predefined files. However, in the case of more complex matters or when making major financial decisions, clients expect face-to-face support. The routing function that transfers the case to a specialized agent ensures high-quality assistance. Audio and video calls make a client feel as if they are being served in a branch office. Collaboration tools facilitate communication and help get things done faster and more efficiently.

How to boost online conversion rates?

It is crucial to ensure easy access to banking services through customers’ favourite communication channels, allowing them to interact with the bank at their convenience. Make sure clients are not discouraged by a long and complicated remote onboarding. Provide simple ID verification and authentication in a well-designed eKYC procedure. Model frictionless end-to-end processes by blending self-service and human support when needed. Empower your agents with remote collaboration tools that help present products and offers in a visualised and understandable way. LiveBank provides the possibility to flag clients with the highest sales potential, and outbound interactions promote a proactive approach to sales.

How to cut the cost of retail customer support?

Leverage LiveBank to reduce remote customer support costs by optimising your resources and processes. Time is money, so focus on shortening the average handle time. Divide your agents into skill groups and use routing to swiftly direct cases to specialized agents, including physical branches employees who can engage in remote customer support with no concern for security. Multi chat enables agents to conduct conversations with several clients simultaneously. LiveBank collaboration tools, predefined links and files, canned responses and quick access to information such as case status and conversation history facilitate communication with clients. The automated eKYC process relieves agents from repetitive tasks and allows them to concentrate on client issues and needs.

Elevate Your Personal Banking Services with LiveBank

LiveBank comes with a plethora of features that will help you grow your organization and personal banking services. From building trust to reducing operational costs – you’ll find everything you need in our single digital solution.

Lower Operational Costs with Virtual Branches

By moving your expert agents into digital contact centers, you may create a fully digital branch and eliminate the need for many of the physical branches you own, hence reducing the operational costs in your bank.

https://livebank24.com/virtual-branch/ →Manage Multi-Generation Clients with Optichannel Solutions

Bridge different touchpoints by integrating data. Enable your clients to choose the most suitable contact channel and switch between them seamlessly. Meet the needs of clients from different generations.

Optichannel Banking →Improve the Quality and Speed of Your Customer Support

Give your customer support agents the tools they need: AI Assistants, access to complete client data and automation. Measure team performance with an easy overview of customer support metrics.

Customer Support →Attract Customers with Intuitive Digital Onboarding

Choose between manual, semi-automated, or fully automated digital onboarding options. Provide your customers with easy, intuitive, fast, and convenient onboarding in line with eKYC standards and acquire more clients due to lower onboarding abandonment rates.

Customer Onboarding →Digital Customer Service and Personal Banking Solutions – The Future of Retail Banking

Digitalization is no longer a dream – it is happening right now. It’s the future of retail banking; hence, so many banks are starting to introduce it. Become one of the leaders and implement our platform for your personal banking products. Gain an advantage over your competition and harvest the benefits of using our IT banking solutions. Transform your organization into a true bank of the 21st century.