Optimize insurance processes, empower agents, and boost sales performance

How livebank can help you optimize insurance operations

-

20%

Improved Response Time

Thanks to AI Helper and fast document exchange, agents receive support in record time, increasing their satisfaction and loyalty.

-

25%

Reduction in Operational Errors

With AI Doc, all documents are centrally managed, preventing mistakes and ensuring regulatory compliance.

-

15%

Revenue Growth

More effective agent support and streamlined process management lead to higher sales performance.

We’ve been transforming the banking experience for years. Now, our innovative solutions are making a significant impact in the insurance industry. By equipping agencies and agents with digital service and sales tools, we help them achieve better results, enhance customer satisfaction, and build stronger relationships. Discover how LiveBank is driving success across three key areas of insurance:

Contact us-

Insurance Agencies

Simplify agent onboarding, centralize document management, and automate repetitive tasks. These tools enhance agent effectiveness, improve customer interactions, and drive higher sales efficiency.

-

Life and Investment

Deliver personalized offers and faster service processes, increasing conversions while reducing errors. From contract signing to policy management, we simplify every step of the customer journey.

-

Group Insurance

Optimize group policy processes, automate claims, and improve communication with clients and agent teams. Intelligent AI tools ensure higher satisfaction and better sales performance.

LiveBank is a part of Ailleron Group

Addressing the Needs of Insurers

Our platform streamlines insurance operations by enhancing agent efficiency, improving customer engagement, and optimizing key processes.

- Agent Onboarding and Support: The onboarding process for new agents is simplified and automated, allowing them to start selling faster. From document exchanges and contract signing to training and ongoing collaboration, the platform ensures seamless agent management. AI-powered tools such as AI Assistant, AI Helper, AI Doc, and AI Summary help agents handle repetitive inquiries and provide key information efficiently.

- Customer-Facing Agent Support: Agents responsible for sales and customer service gain access to product information, pricing details, and negotiation tools, enabling them to manage sales more effectively. Integrated tools allow them to quickly resolve issues, process claims, and track case statuses, leading to higher customer satisfaction and increased sales.

- Comprehensive Customer Service in One Platform: The platform integrates all stages of the sales and customer support process, enabling agents to manage the entire journey—from first contact to contract finalization. With instant access to a knowledge base and support tools, agents can respond to customer inquiries quickly, enhancing satisfaction and trust.

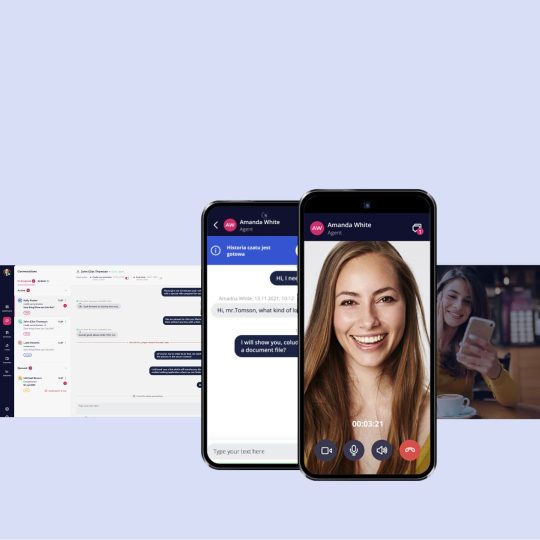

- Advanced Communication Tools: Multiple communication channels, including video chat, enable agents to engage directly with customers, resolve issues faster, and strengthen relationships. This modern approach increases efficiency and improves client retention.

- Secure and Centralized Document Management: The platform centralizes and automates document workflows, reducing errors, accelerating processing times, and ensuring compliance with industry regulations. Sensitive data, such as medical records, is securely managed in a cloud-based environment.

- Automated Risk Assessment and Policy Management: The risk assessment process is fully automated, minimizing errors and delays. Every step—from data collection to contract signing—takes place within a single system, utilizing e-signature solutions (e.g., Autenti, mSzafir) to expedite policy finalization and operational efficiency.

- Data Analysis and Offer Personalization: Advanced analytics tools enable insurers to tailor insurance and investment offers to individual customer needs. This improves sales effectiveness, enhances customer satisfaction, and fosters long-term loyalty.

- Operational Monitoring and Support: Automated tools track inquiries and problem resolution, allowing insurers to respond swiftly to agent and customer needs. This increases operational efficiency and ensures smooth service delivery.

- Competitive Positioning and Sales Optimization: The platform enables agents to differentiate themselves in the market through offer personalization and competitive analysis tools. By guiding customers through offers interactively, agents can highlight value propositions effectively and close deals more efficiently.

By addressing these challenges, insurers can optimize operations, empower agents with the right tools, and provide an enhanced customer experience, leading to higher satisfaction and business growth.

-

AI Assistant

An intelligent assistant that automatically responds to routine agent inquiries, enabling quick problem resolution and reducing the workload on the support team.

-

AI Doc

An automated document management tool that minimizes the risk of errors and ensures compliance with legal regulations.

-

Fast Data Exchange

Seamless integration enables instant transmission of documents and information between agents and the support team, reducing response time and enhancing operational efficiency.

Discover more on our blog

Learn more about Digital Customer Service in Insurance: the challenge of personalization in the age of technology

You did not find the answer? Write to us – we will try to help

We focus on speed and adaptability. The process is quick and tailored to you and your needs! Want to join us? It’s easy!