Boost Your Business with LiveBank’s Advanced Identity Verification and eSignature Platform for Banks

Empowering Cost-Efficient Identity Verification and eSignatures for Effortless and User-friendly Processes

Welcome to LiveBank

Welcome to LiveBank, your gateway to cutting-edge solutions in identity verification and electronic signatures (eSignatures). In today’s fast evolving world of digital finance, ensuring secure and efficient processes is paramount. With LiveBank, you can embrace the future of identity verification and eSignatures with confidence.

Boost Your Business with Our Technology

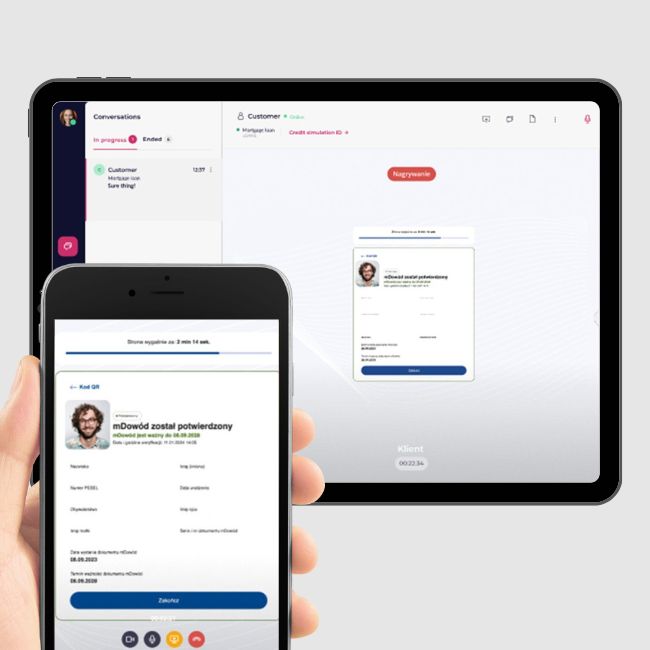

At LiveBank, we offer a comprehensive eSignature platform designed to revolutionize the way how businesses verify identities and sign documents electronically. Our advanced technology integrates seamlessly with industry-leading eSignature providers like DocuSign, ensuring flexibility and compatibility with existing workflows. Additionally, LiveBank collaborates with ID brokers such as IDnow, mObywatel, Autenti, and more, enhancing the identity verification process by tapping into trusted sources of ID verification software.

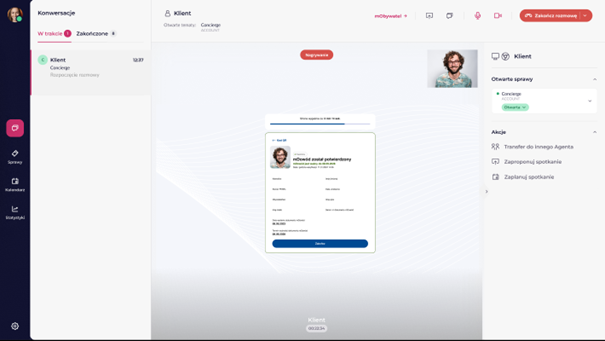

Identity Verification Platform for Banks: Elevating the LiveBank Experience

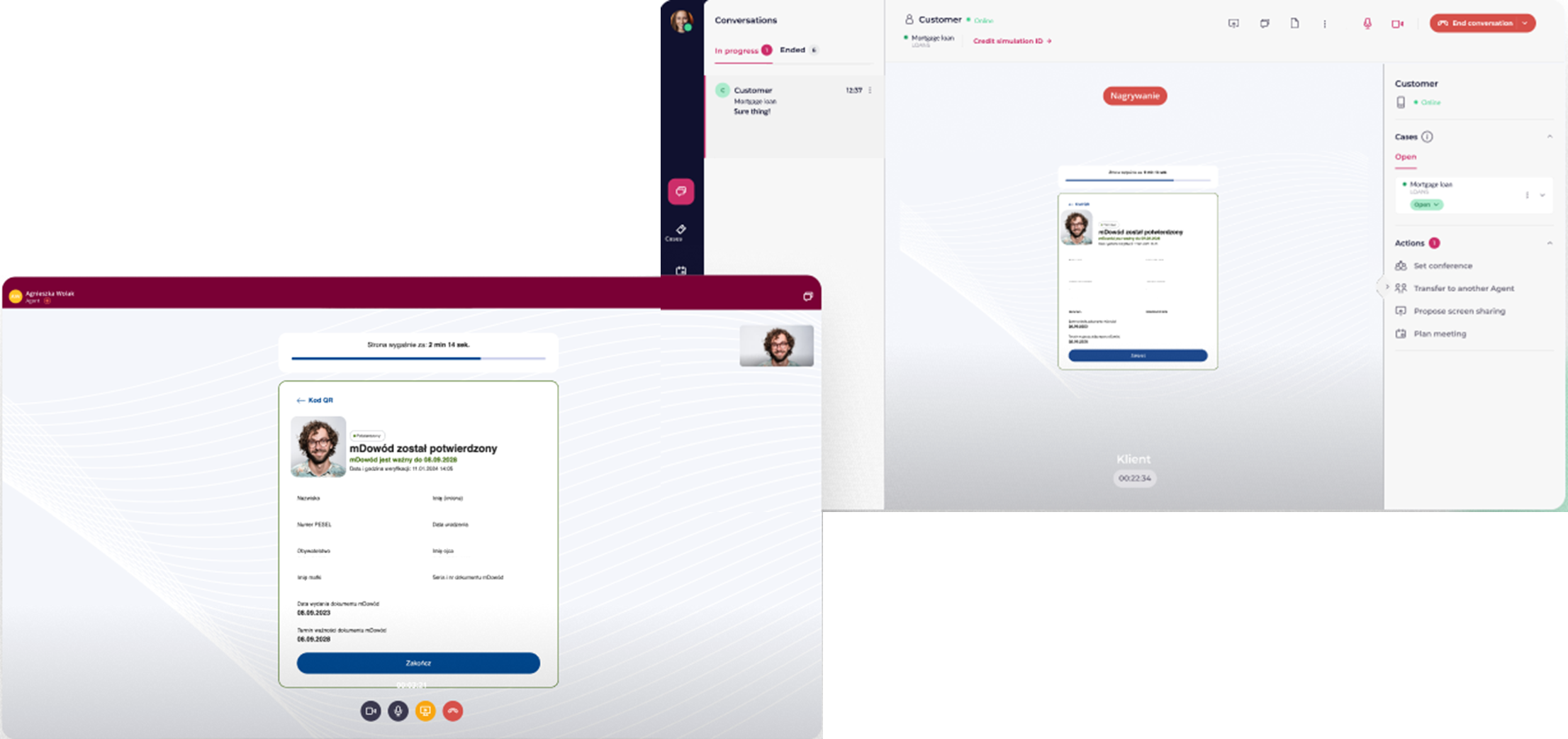

We’re experts in digital identity verification solutions, and we know how to revolutionize the way identity verification may look like. And we’re doing this in our identity verification platform for banks, offering an exhilarating experience for our customers. With seamless integration capabilities with top identity brokers, everything happens effortlessly within our application, ensuring a thrilling journey for users. Picture this: a single, unified eSignature solution where customers not only communicate with the bank, verify their identity seamlessly, but also sign agreements and buy available financial products. It’s a game-changer, offering an electrifying experience that redefines convenience and reliability. You don’t want to lose the chance to be part of this revolution we started, do you?

LiveBank becomes more than just a tool—it’s the epicenter of a dynamic and exhilarating banking experience, setting the stage for a thrilling future of streamlined interactions and unparalleled security.

LiveBank: Redefining Document Signing with Dynamic eSignature Solutions

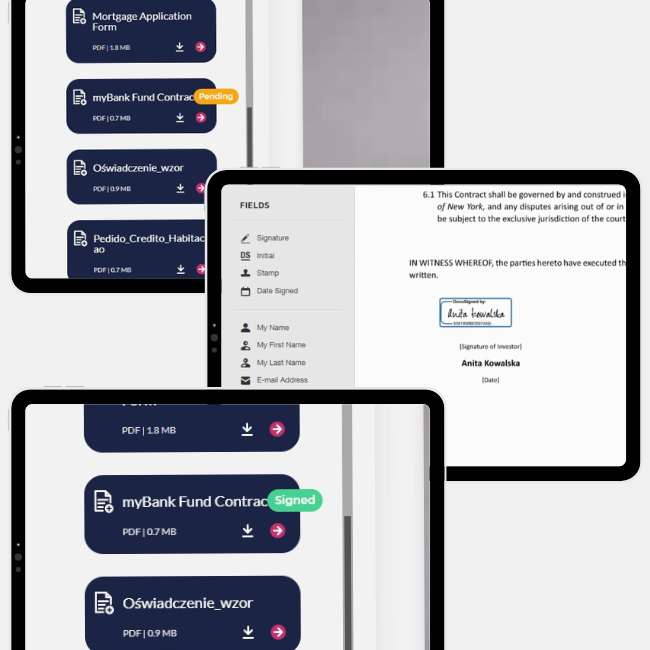

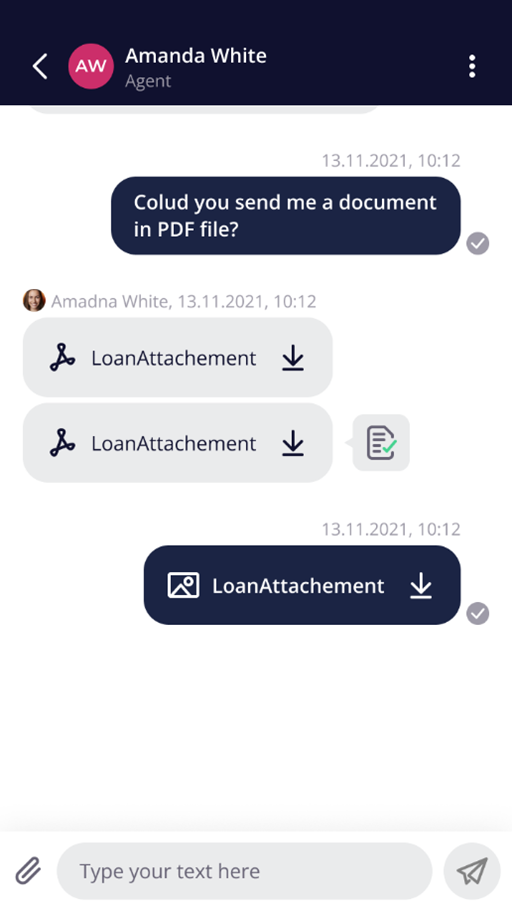

LiveBank offers an unparalleled eSignature platform, allowing users to present, review, and sign documents within a single live video interaction. Whether it’s presenting an offer, a contract, or an addendum, our platform enables users to finalize agreements directly with clients in real-time. This feature addresses a common need expressed by clients for an end-to-end process within one interaction. Moreover, the system ensures the auditability of signed documents, providing a comprehensive record of all transactions performed. We support both ‘basic’ and ‘qualified’ eSignature options, catering to a wide range of document needs. Additionally, users have the flexibility to determine the signing order, empowering them to tailor the process according to their preferences. With LiveBank’s eSignature software, businesses can enhance efficiency and deliver a seamless experience to clients, all within a single interaction.

Unlock the Potential

Discover the limitless possibilities of LiveBank's platform:

-

Identity Verification Platform for Banks

• Seamlessly onboard new customers while maintaining rigorous identity verification standards.

• Facilitate secure online transactions by verifying the identities of users in real-time.

• Ensure compliance with regulatory requirements and bolster fraud prevention measures.

• Embark on an electrifying journey as you effortlessly integrate with the industry’s top identity verification service providers (ID Brokers) -

eSignature Platform for Banks

• Streamline contract signing processes by enabling secure electronic signatures from anywhere, at any time.

• Accelerate business workflows by eliminating paper-based document signing and manual processes.

• Guarantee the authenticity and integrity of electronically signed documents for legal purposes.

• Unlock the excitement of choice as you harness the power of any eSignature service provider on the market.

Get in touch and try it out for yourself

Your options are limitless with us—because why settle when you can soar?

Integration and Collaboration

LiveBank goes beyond standalone solutions. We prioritize integration and collaboration, ensuring that our platform seamlessly integrates with leading eSignature providers. Furthermore, our partnerships with ID Brokers enhance the identity verification process by leveraging trusted sources of identity data. With LiveBank, you can harness the power of collaboration to elevate your ID verification software and eSignature processes to new heights.

Experience the Future with LiveBank: Join the ranks of forward-thinking businesses that are embracing the future with LiveBank. Discover how our advanced platform can revolutionize your identity verification and eSignature processes, bringing efficiency, security, and peace of mind to your business operations. Unlock the full potential of digital transformation with LiveBank today.

Identity Verification for Banks

Current Challenges: Today’s businesses operating in the web face numerous challenges with identity verification. Traditional methods involve manual verifications that are not only time-consuming but also prone to errors and security risks. Customer identity verification carried out through obsolete procedures leads to delays in onboarding and transactions, hindering business efficiency.

Our Promise: LiveBank addresses these pain points by offering a seamless and secure identity verification process. Leveraging advanced technology and integration with trusted ID brokers such as IDnow, Signicat, mObywatel, Autenti, and many others we enable businesses to authenticate identities swiftly and accurately. Our platform streamlines the verification process, ensuring compliance with regulatory requirements and enhancing fraud prevention measures.

Forthcoming Perspectives: The future of identity verification with LiveBank is bright, as through enhanced security, straightforward process we have a real impact on the increase of customer trust. With the continuous advancement of technology and data integration capabilities, the process of identity verification will become even more efficient and seamless. Businesses can expect a shift towards real-time verification methods and increased reliance on digital identity solutions to meet evolving customer expectations and regulatory standards.

eSignature

Current Challenges: The process of obtaining signatures for important documents has long been plagued by inefficiencies and logistical challenges. Traditional paper-based methods are time-consuming, environmentally unfriendly, and hinder remote collaboration. The need for in-person signatures imposes constraints on business operations and slows down transaction processes.

Our Promise: We revolutionize the eSignature process by offering a secure and convenient solution that allows users to sign documents electronically from anywhere, at any time, on any device or platform. By eliminating the reliance on paper and physical presence, our platform streamlines workflows, accelerates transactions, and reduces the environmental footprint. Integration with leading eSignature providers like DocuSign, Adobe Sign, HelloSign, and many others ensures compatibility and flexibility for businesses of all sizes.

Forthcoming Perspectives: The potential ahead of eSignature with LiveBank is destined for success ushering in an era of improved efficiency, flexibility, and sustainability in document management. As businesses increasingly adopt digital transformation initiatives, the demand for electronic signature solutions will continue to grow. With advancements in encryption technology and regulatory acceptance of eSignatures, the process will become more widely adopted across industries, driving greater productivity and cost savings.