Outbound management – the power of proactive communication in the banking sector

Send messages to your customers whenever you prefer

Efficient Customer Communication with Outbound Management for Banks

Outbound management encompasses a range of solutions that help companies effectively deliver marketing and sales messages to a broad customer base. Within digital channels, LiveBank offers several mechanisms for this communication, including mass outbound messaging and broadcasts on social media platforms like WhatsApp. This approach allows for quick and efficient communication with customers, enabling companies to send messages to hundreds or even thousands of people simultaneously. Whether promoting a new product, offering a loan, or sharing important updates, outbound management makes it easy to reach your audience.

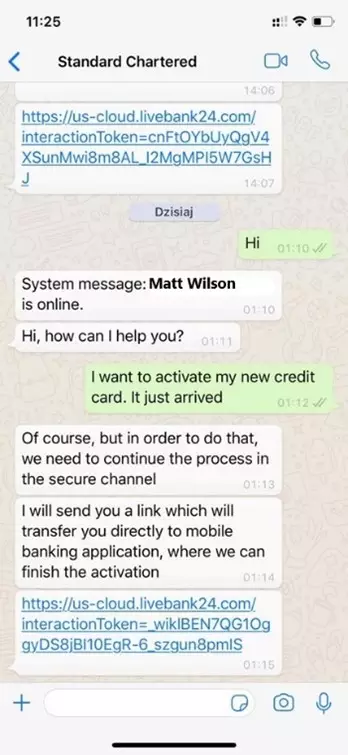

Option 1: Mass Communication on Social Media

Using popular platforms like WhatsApp or Messenger, you can reach customers through their preferred communication channels. Broadcast messaging allows you to send specific messages to pre-created groups of customers. Unlike group chats, these messages create individual conversations, ensuring recipients are unaware that the message has been sent to multiple contacts, thereby increasing its effectiveness. Agents can see the content sent to customers, providing seamless communication. LiveBank offers a dedicated module for this communication, including integration with channels such as WhatsApp. The sender can prepare a distribution list by selecting contacts from a list or importing contacts from a CRM. Messages can include text, files, or video recordings. After sending, you can track the effectiveness of your campaign through detailed reports.

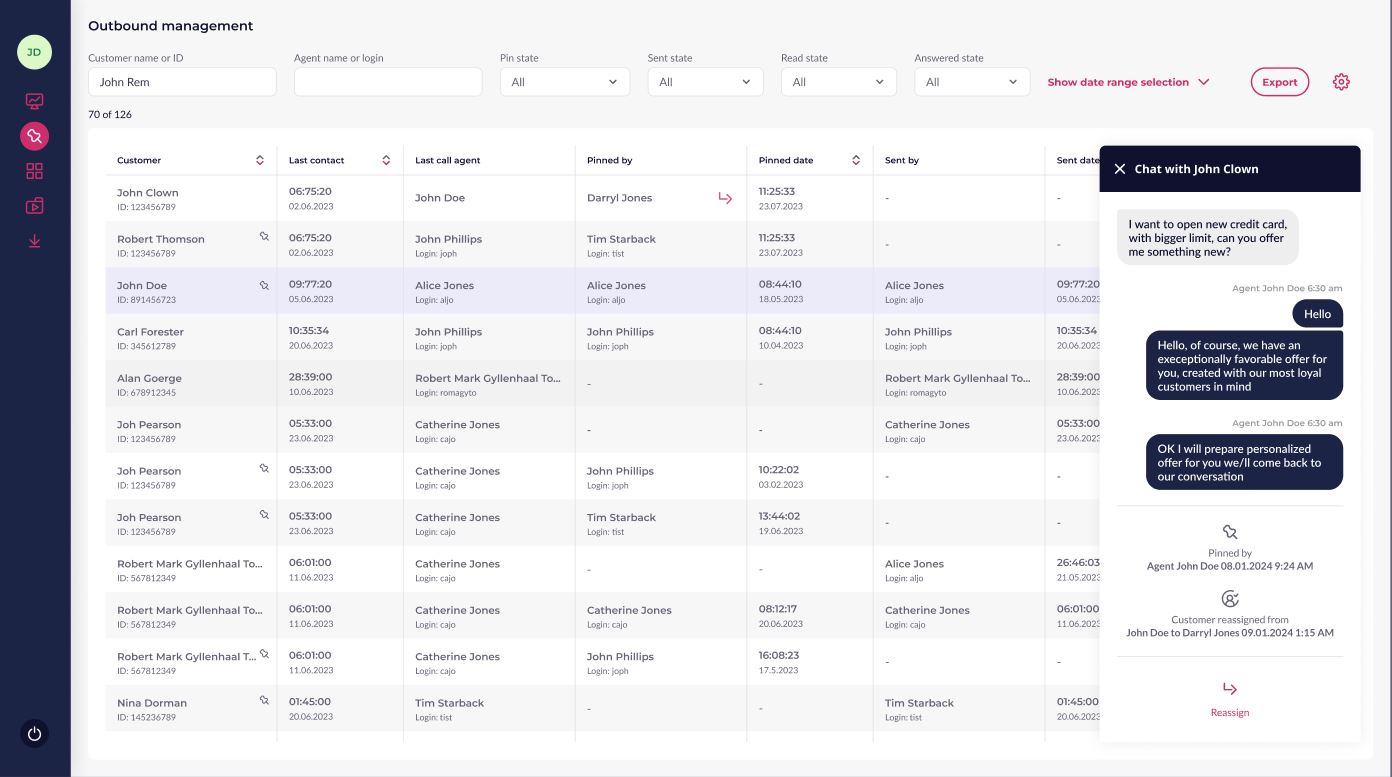

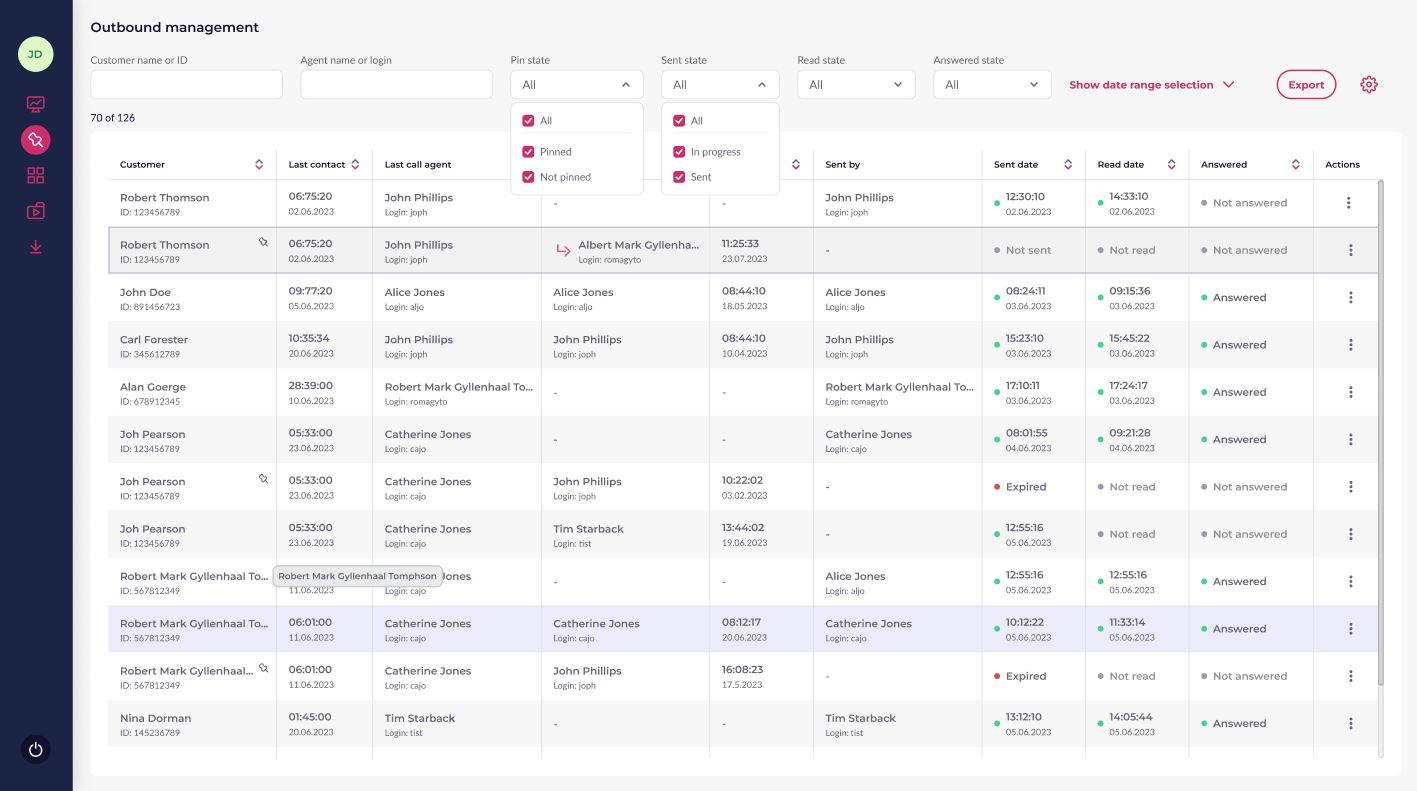

Option 2: Outbound Chats to Authenticated Customers

For financial institutions, secure communication with customers is crucial due to regulations like GDPR and PSD2. Using internal platforms like online or mobile banking ensures that only authenticated customers gain access to the sent materials, enhancing communication security. LiveBank supports both incoming inquiries and proactive outbound communication from advisors. Advisors can actively send messages to authenticated customers, building and maintaining relationships. These messages are visible in the chat window and form part of the customer’s correspondence history. Advisors can provide information on scheduled meetings, loan offers, or other important matters. Integration with push notifications ensures customers are quickly informed about new messages available upon logging into the portal, increasing communication effectiveness. Customers can respond to these messages at any time, with advisors having full access to the conversation history.

Option 3: Integration of Communication Channels in Advertising Messages

Combining marketing activities (e.g., pop-ups, emails) with chat or video communication opens new possibilities for customer engagement. LiveBank facilitates the easy implementation of call-to-action buttons in external communications. A customer interested in an offer can click the button to initiate an interaction with an agent. This integration includes information about the conversation topic (e.g., the campaign name), allowing advisors to provide relevant information quickly.

Faster, More Effective, and Cost-Efficient – Summary of Outbound Management for Banking

Using mass outbound chat in LiveBank offers numerous benefits, especially in banking, where quick and effective communication with customers is crucial. Personalized messages sent via outbound chat increase customer engagement and communication effectiveness. The ability to segment recipient lists allows for targeted, personalized messages to different customer groups, making it particularly useful for differentiating communication between individual and business clients.