Empower your team and delight customers with advanced AI tools for banking

Enhance productivity | Automate processes | Accelerate sales opportunities

Picture the perfect blend of technology and human touch, elevating customer engagement

Speed, precision, and personalization are pivotal factors for success in a dynamic business environment. Utilize knowledge and customer data analysis not only to increase upsell volumes but also to offer the most tailored products in cross-selling. By providing what the customer needs at the right time, you enhance conversion and hit rates.

LiveBank AI Assistant for banks

LiveBanks AI Assistant for banking is an advanced solution designed to support your employees during customer conversations. The software includes two functionalities: AI Helper and AI Prompter. Both can work in an isolated environment, without the need to use public services. This means that we can configure a solution within your internal network, ensuring full control and data security, which is crucial from a regulatory perspective in the financial sector. Additionally, as part of AI Banking Assistant, we offer a unique function of referring to the source (e.g. document) that was used to prepare the response. The advisor can therefore check the source material, thus confirming the adequacy and transparency of the generated content. AI Assistant can enhance created materials with graphic elements, such as card patterns, which emphasize the solution’s uniqueness and advantages.

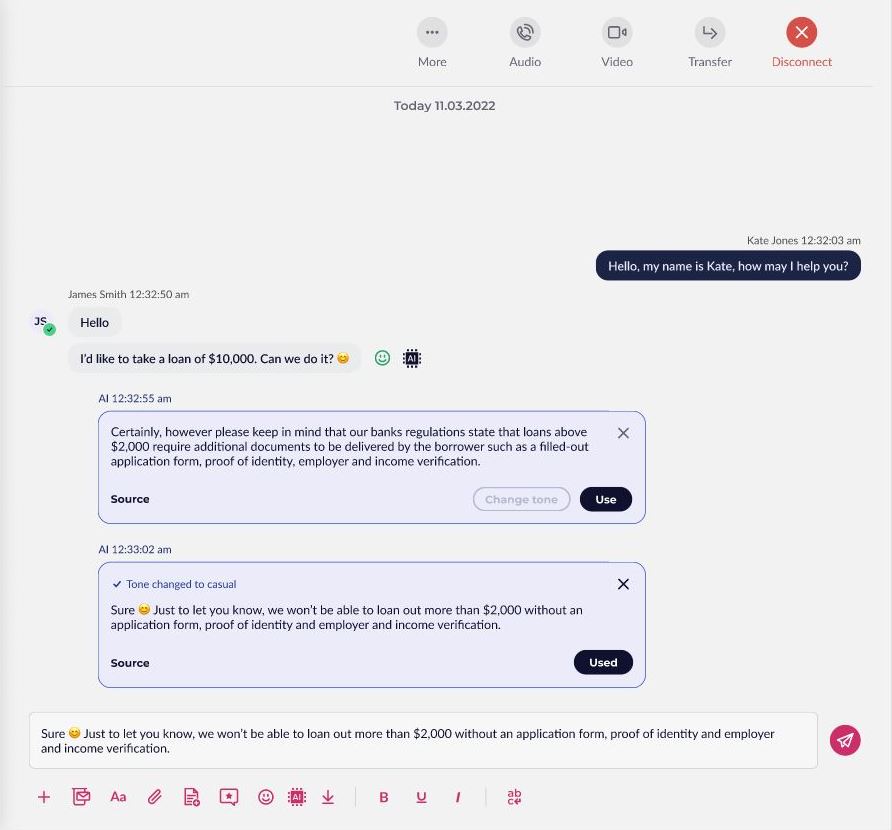

AI Helper in banking

The support feature is a handy tool available to advisors during chat conversations, allowing them to answer clients’ questions quickly and efficiently. Once activated, an AI Helper analyzes the conversation history and generates a personalized answer to the client’s query as indicated by the advisor. Importantly, such a response is ready to be sent directly to the customer from the conversation module. This feature greatly reduces the time and effort that the advisor would typically spend searching for information from other sources or crafting a message. The advisor maintains full control over the content they send to the client, including the ability to adjust the tone of their messages to suit the client’s needs. By using this tool, advisors can significantly decrease their response time and enhance the quality of their assistance. With this unique opportunity, advisors can provide their clients with a better support experience, ultimately leading to increased satisfaction and loyalty.

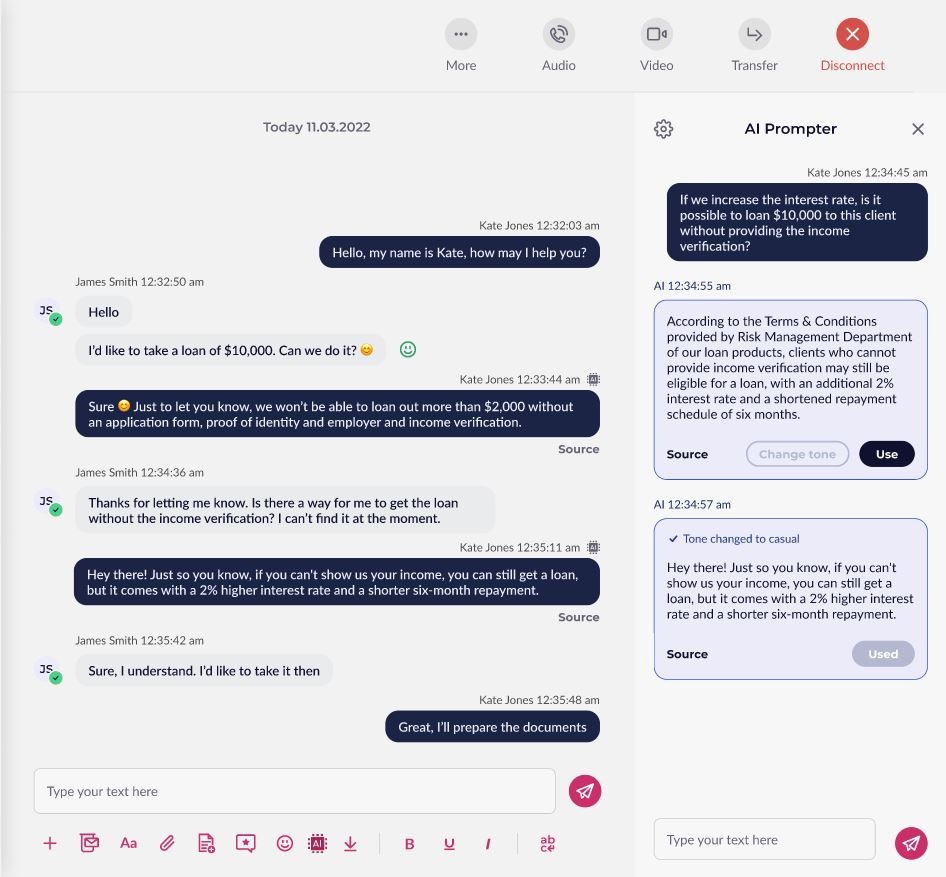

AI Prompter

For more complex queries, advisors can use the advanced AI Prompter tool to explore specific customer problems in more detail, provide additional context, and ultimately find solutions. Advisors can ask more accurate questions directly to the AI Prompter to get personalized answers. Utilizing sophisticated algorithms, it consolidates various sources, including banking regulations, promotional offers, and fee tables. Based on their experience, advisors ask more precise questions and thus receive more detailed information. This unique tool eliminates the need to verify multiple sources of knowledge but also allows the advisor to deepen his knowledge of processes and products. In sum, AI Prompter works on the Advisor’s questions, unlike AI Helper which is based on the client’s questions and history.

AI Powered product recommendations

Ailleron can deliver an AI product recommendation tool or integrate it with an existing solution thanks to this employees using LiveBank gain additional possibilities. Ailleron solution employs advanced Machine Learning to analyze extensive customer data, ensuring precise, personalized product recommendations to each customer’s unique profile. This includes not only basic demographic information but also nuanced attributes, such as past purchase history, and preferences. Advisors receive real-time hints during interactions, enhancing their ability to guide customers effectively. Additionally, the system enables outbound communication planning, allowing advisors to proactively engage customers with tailored offers. This approach optimizes customer experiences, boosts advisor efficiency, and creates opportunities for upselling, ultimately fostering meaningful and profitable customer relationships.

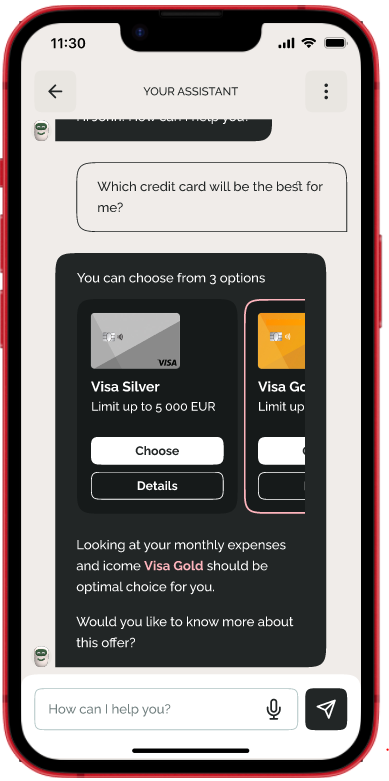

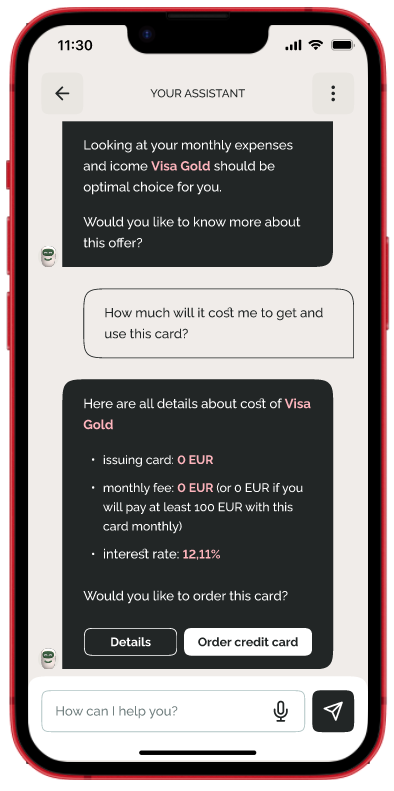

AI powered banking chatbot

The chatbot speeds up service by formulating responses in natural language. It uses generative artificial intelligence (Generative AI) and Large Language Model (LLM) to prepare responses. Provides immediate, 24/7 customer service, reducing response times and improving customer satisfaction. The goal is to effectively manage typical customer questions that often absorb the time of the service team. Importantly, a chatbot can become the first line of contact with customers each day but allows transfer to a living employee if needed. This allows you to focus the attention of the service team on more complex issues and situations that require their specialist knowledge. Advisors focus only on conversations where their commitment is necessary or there is a possibility of additional sales (UP-Selling/Cross-Selling). The introduction of this solution not only improves the customer service process but also allows the company to focus its team on valuable interactions that generate additional business opportunities.

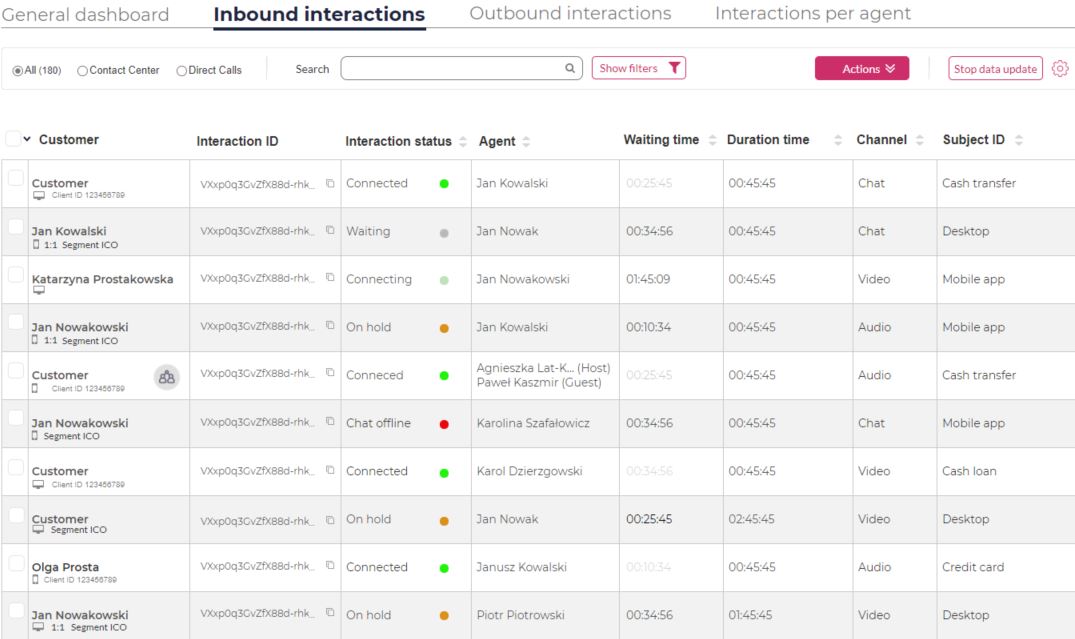

AI Customer Prioritization

Ailleron can deliver an AI Customer Prioritization tool or integrate with an existing solution thanks to this employees using LiveBank gain additional possibilities. AI Customer Prioritization introduces a revolutionary approach to segmenting and prioritizing customers. By analyzing factors like customer value, commitment levels, and specific needs, it takes customer-centricity to new heights. The solution can be integrated with various systems for inbound/outbound traffic management as well as database creators and marketing campaigns. Integration with LiveBank allows you to build new rules for directing calls to the right advisors. Customers no longer have to wonder about the right choice of conversation topic, because we ensure more effective directing customers to employees with the appropriate skills. The result is a win-win situation: customers receive personalized service and employees engage in tasks consistent with their set of competencies.

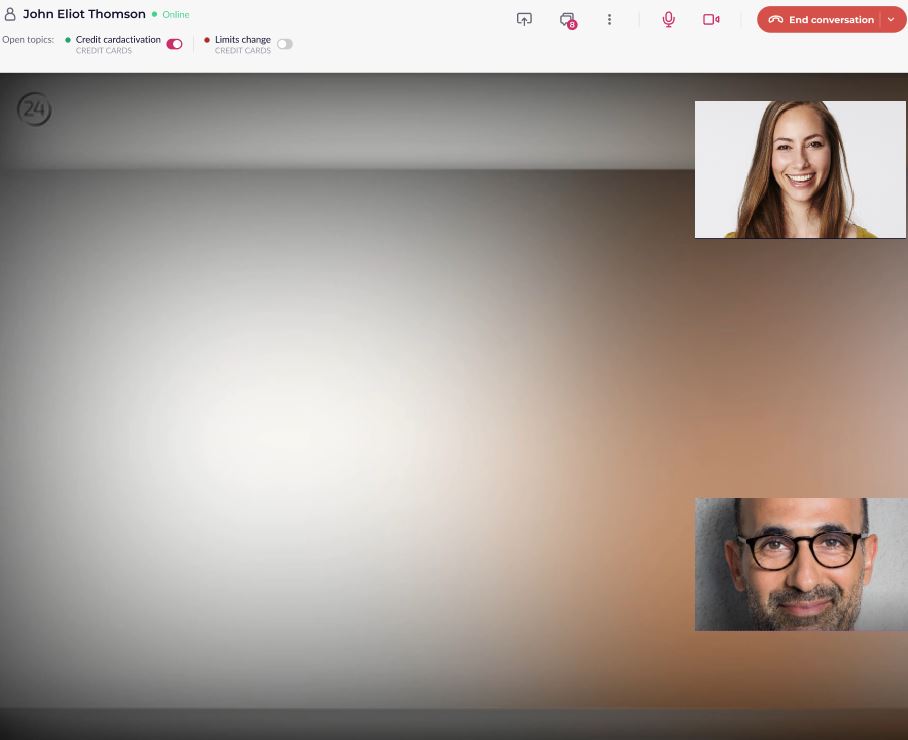

AI Blur

AI Blur is a solution that focuses on protecting sensitive information during video calls and screen-sharing sessions.. It uses advanced real-time image-blurring technology to safeguard any confidential data shared during the interaction, such as login credentials and passwords. The first step to implementing the solution is to determine which page previews need to be blurred. The blurring starts and stops seamlessly based on predefined situations, allowing for dynamic adaptation to the presented content. This ensures that sensitive information is protected throughout the entire screen-sharing interaction, and not just in real-time. Additionally, AI Blur extends its protective measures to recorded content. Any blurring that occurred during the live interaction persists when the session is played back, providing a comprehensive solution for ensuring privacy and security measures are upheld during both live interactions and review of recorded sessions. AI Blur is the ideal solution for organizations that prioritize customer privacy standards during screen-sharing sessions.

Ensure meaningful interactions, building trust and loyalty while creating a seamless connection between your bank and your clients.

What have customers achieved with us?

-

0 to 55%

digital sales processes of complex products

-

up to 95%

reduction in customer acquisition costs for digital customer onboarding

-

20%

increased employee efficiency by using digital meetings

Why Do You Need AI Tools in Banking?

Do you wish to cut the ever-growing operational costs? Or gain an edge over your competitors? Perhaps you are looking for ways to improve your customer experience? All of these can be achieved in banking with AI-powered tools. How can we be so sure about it? It’s financial professionals who confirm it.

According to a Statista Research Department Study conducted on 400 financial service professionals from all over the world, implementing AI in banking comes with the following benefits:

- creating operational efficiencies (43% in 2023),

- creating a competitive advantage (42% in 2023),

- improving customer experience (27% in 2023),

- yielding more accurate models (27% in 2023),

- opening new business opportunities (23% in 2023),

- reducing total cost of ownership (14% in 2023).

As you can see, implementing AI prompters, helpers, data analytics tools, and smart AI assistants in banking will not only help you improve your organization but also allow it to grow more rapidly, and people in the finance sector know it. Hence, you don’t want artificial intelligence – you need it to elevate your organization to the next level.

AI Tools from LiveBank – Models You Can Count On

At LiveBank, our priority is understanding bank customers and clients. Therefore, our AI banking tools are designed with your and your customers’ needs in mind.

From simple tools like AI Blur to prevent sensitive data leaks to a complex AI Assistant, our platform comes with all the artificial intelligence models you need in banking. Each was carefully designed to ensure that you can use its potential to the maximum – it is simply your go-to solution. Add to that the fact that our platform comes with a plethora of other helpful functions for particular sectors (e.g., our digital mortgage solutions), and you get the ultimate software for any financial organization. Contact us and get a quote now.

-

Efficiency and Cost Savings

-

Enhanced Customer Engagement

-

Continuous Improvement with Data Insights

Unlock intelligent banking: discover how we can Boost your business!

Leave us your contact information, and we will get in touch with you to discuss the details.