Revolutionary Customer Onboarding Platform with LiveBank’s Dynamic eKYC Integration Capabilities

Accelerate Growth through Seamless Digital Onboarding, Unleashing the Power of eKYC and Cutting-Edge Identity Verification

Facilitate a Seamless Customer Onboarding Journey with eKYC Integration

In the dynamic landscape of digital customer interactions, LiveBank stands at the forefront, offering innovative solutions to transform the digital onboarding experience in banking. Our platform seamlessly integrates cutting-edge eKYC (Electronic Know Your Customer) processes, streamlining digital identity verification for swift and secure customer onboarding. Whether the eKYC solution is a solution developed in-house by our company, acquired from our extensive portfolio, or integrated seamlessly with any available solution through third-party ID Brokers, LiveBank ensures a unified and efficient onboarding journey for our clients. This versatility allows businesses to choose the eKYC solution that best suits their needs while maintaining the highest standards of security and compliance.

Revolutionizing eKYC: LiveBank’s eKYC Processes Tailored for Automated Efficiency or On-Demand Assistance

LiveBank empowers customer onboarding software with the flexibility to customize various types of EKYC processes tailored to their specific needs, whether it’s fully automated, fully assisted, or with on-demand assistance. This dynamic approach ensures that financial institutions can seamlessly adapt their processes to align with product requirements and compliance regulations, all while maintaining full control over the steps and content. With LiveBank, the possibilities for innovation and efficiency in identity verification are endless, putting businesses at the forefront of modern banking experiences.

Unlock the potential of your eKYC experience with LiveBank’s groundbreaking approach

Craft your verification journey effortlessly using dynamic “blocks” – each representing a strategic step in the process. Arrange these building blocks in a sequence that suits your preferences, creating a fully customizable and uniquely tailored eKYC process. With LiveBank’s intuitive low-code platform, you have the creative freedom to shape the visual aesthetics, choose captivating button names, and define the actions taken at every stage. Whether it’s determining the number of steps, their sequence, or even the overall look and feel, LiveBank’s innovative low-code solution empowers you to sculpt an eKYC process that aligns seamlessly with your distinctive needs. Elevate your onboarding experience – where customization meets efficiency, LiveBank leads the way.

-

Digital Customer Onboarding

Embark on a frictionless digital onboarding journey with LiveBank’s state-of-the-art platform. Whether clients prefer the convenience of mobile devices or web browsers, our unified application ensures a consistent onboarding experience. Explore the flexibility of scheduled onboarding sessions for planned interactions or opt for on-demand communication to meet immediate customer needs.

-

eKYC Integration

Experience the power of eKYC in simplifying the onboarding process. LiveBank’s platform incorporates advanced electronic identity verification, allowing swift authentication of customer identities. Our robust eKYC integration ensures compliance with regulatory standards while expediting the onboarding journey for both clients and advisors.

-

ID Brokers

Moreover, LiveBank extends its capabilities by integrating seamlessly with leading ID Brokers such as IDnow, Signicat, Onfido, mObywatel, Identt, Autenti, and more. This synergy empowers businesses to leverage established identity verification systems, ensuring a harmonious onboarding process that is not only efficient but also aligns with industry best practices. Join us on a journey where digital onboarding is not just a process; it’s an opportunity to create lasting impressions and set the stage for exceptional customer relationships.

-

Digital Identity Verification

Immerse your clients in a secure and efficient digital identity verification process. LiveBank’s onboarding system is equipped with advanced tools to authenticate customer identities seamlessly. Clients can confidently complete the verification process through various channels ensuring a versatile and user-friendly experience.

Top Key Features

-

Seamless 3rd Party Brokers eKYC Integration

Experience effortless identity verification with LiveBank’s eKYC processes, by integration with 3rd Party ID Brokers and ensure access to official data sources, simplifying the identity verification process and enhancing overall efficiency.

-

Choose our eKYC module for even more immerse and unified experience

Elevate your onboarding process by offering a personalized and streamlined journey that aligns perfectly with your business requirements.

-

Craft your own process

Tailor the eKYC process precisely to your needs by building it from scratch using our customizable elements, ensuring a solution perfectly aligned with your unique requirements.

-

Flexible eKYC Process Types

Choose between Automated, Fully Assisted, or Hybrid options, tailored to Your Business Needs

-

Secure Digital Identity Verification

Employ advanced tools for digital identity verification, ensuring a secure onboarding experience at the same time.

-

Regulatory Compliance

LiveBank’s eKYC module ensures compliance with regulatory standards, offering peace of mind for both clients and advisors.

Customer Onboarding Software with eKYC Process

Automated and secure verification of customer identity during the online registration process to reduce onboarding time and enhance efficiency.

-

1. Instruction

Initiating the eKYC process, providing a brief overview of the upcoming steps and the necessary documents for the Customer to prepare.

-

2. Collecting approvals

The customer agrees to the terms of using banking services and consents to the processing of their personal data for identity verification purposes.

-

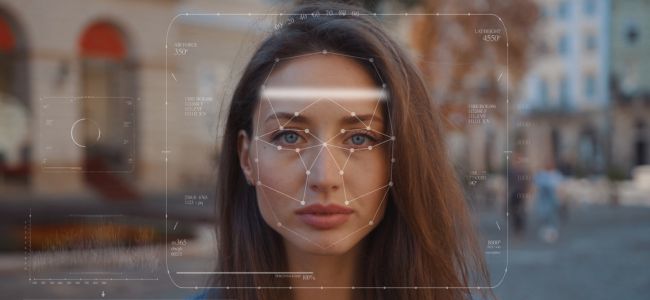

3. Taking photos (ID & Selfie)

The customer is prompted to take/submit images of identity documents, such as an ID card, as well as taking a selfie for biometric verification.

-

4. Liveness check

The customer is requested to undergo biometric verification, such as blinking eyes or reading sample text to confirm their liveliness and identity.

-

5. OCR / Biometrics

The eKYC system analyzes the submitted documents, verifying their authenticity and compatibility with the provided personal data.

-

6. Verification in databases

Customer data is cross-referenced with potential entries in AML, CFT & other databases.

-

7. Data confirmation

Upon completion of all checks, the Customer is asked to confirm the accuracy of the collected data.

-

8. Process result

The customer is notified of the verification process results, and in the case of success, can proceed with the registration process, opening an online bank account.

Find out how we create a business process for onboarding new Clients

Discover our approach to crafting a seamless customer onboarding platform process for new clients, designed to streamline their integration and ensure a smooth transition into our services.

Results

-

Reduced customer onboarding time.

-

Efficient and secure online identity verification.

-

Increased customer trust in the bank’s online processes.

-

Compliance with security and identity verification regulations.

Empower your business with LiveBank’s eKYC capabilities

transforming digital onboarding into a secure, seamless, and regulatory-compliant experience for your customers.