Digital banking for SME – effectively change your customers’ UX

Unique Customer Experiences – Harmonious Communication on All Channels for Better Business Results

SME & Corporate digital banking platform

Customer service for small and medium-sized enterprises (SMEs) and corporations is a multifaceted endeavor. One of the main challenges is understanding the unique needs and expectations of corporate clients. Providing high-quality service and customer satisfaction is a priority for advisors. There are many aspects that influence corporate customer service, starting from product needs (different for small businesses versus corporations), through complex structures (e.g., holding companies), to the scale of operations (handling multiple accounts and transaction volumes). The dynamic nature of business requires financial institutions to be flexible and quickly respond to changing customer needs. As the LiveBank platform, we provide the appropriate infrastructure and data security that enable fast, efficient, and personalized customer relationship management.

Digital banking for SME and Corporations – Understanding the Challenges

Onboarding

In a business environment, first impressions are crucial, and an easy, seamless transition through the implementation process is one of the keys. Using digital channels to engage customers in this step allows navigating customers directly in SME enterprise banking.

During the onboarding process, support personnel act as guides for clients throughout the entire process. They not only provide necessary assistance but also educate them about products and services. Acquiring new customers, regardless of whether it is a single person or a corporation, thanks to LiveBank can be quick and easy.

Check more to learn what we offer on onboarding:

Customer service in digital banking for SME and Corporations

-

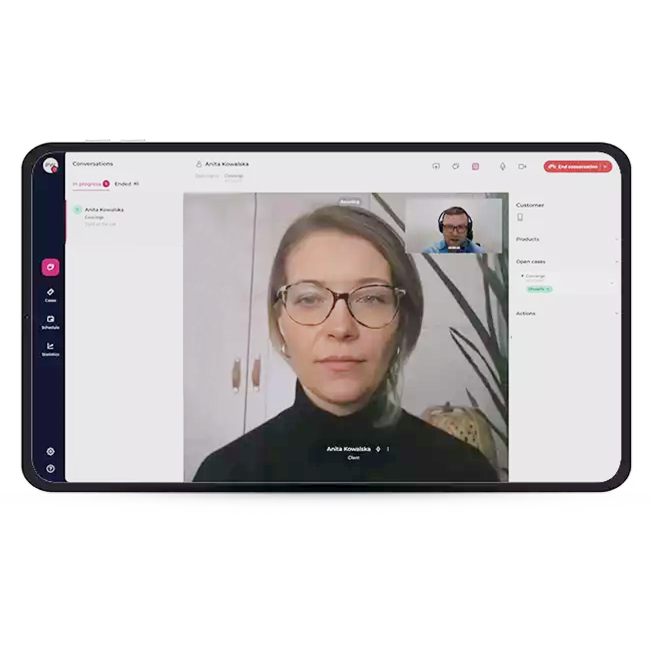

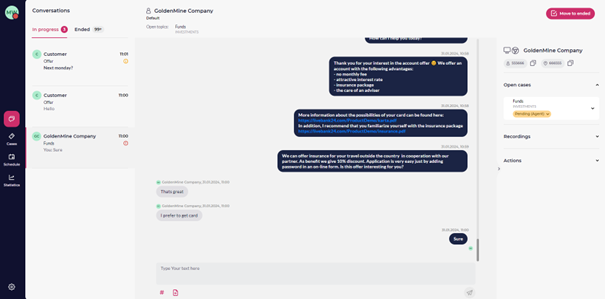

In the banking sector for a corporate client, it is important to be individual, as each company has its own unique needs. Therefore, the client must have access to a dedicated manager in the branch or Contact Center who will be able to understand his individual needs and propose appropriate solutions. The LiveBank platform allows customers to communicate with their advisors through various channels directly from SME banking software. Full secure messenger or integration with other platforms ensures flexibility and convenience in communication.

-

These companies may have different priorities and expectations towards the bank, which requires flexibility and an individual approach on the part of the financial institution. In LiveBank, each interaction is assigned to a customer, which allows you to create a contact history for a specific user. When establishing a connection using mechanisms such as Single Sign On, we transfer information about the customer’s identity directly from the financial institution’s system to the specialist’s panel.

-

By preserving the customer’s authenticated identity (SSO mechanism) during the initiation of LiveBank chat or video calls, we eliminate the need for repeated authentication, ensuring a seamless integration with CRM and other SME banking software that utilize customer data.

-

Delivering personalized customer service and analyzing customer behavior and preferences is one of the key indicators of success. To provide more precise topics for inquiries and conversations conducted through the LiveBank system, we have introduced the ability to track activity based on Cases. Thanks to the case tracking mechanism, customer inquiries can be carried out for the time needed to solve them – the specialist has an overview of the current status of the case.

Human touch

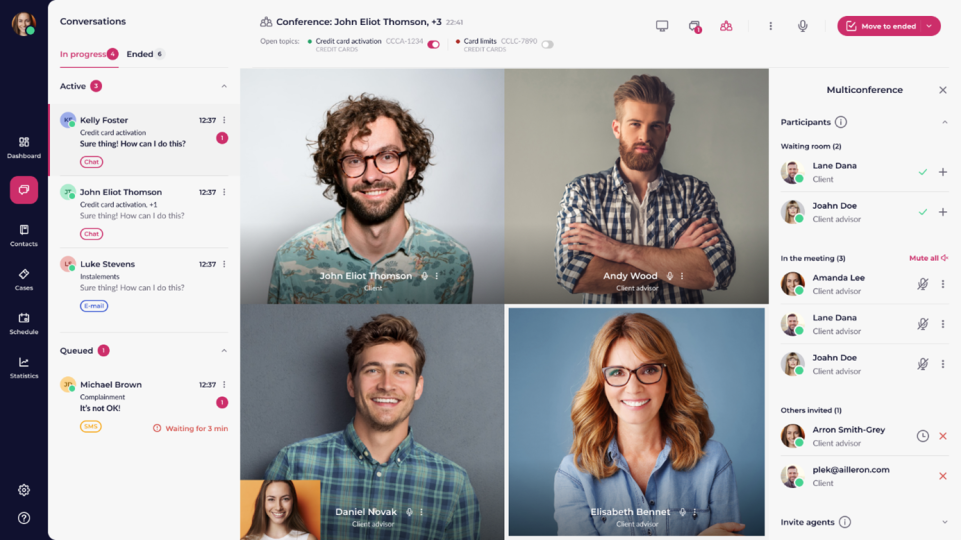

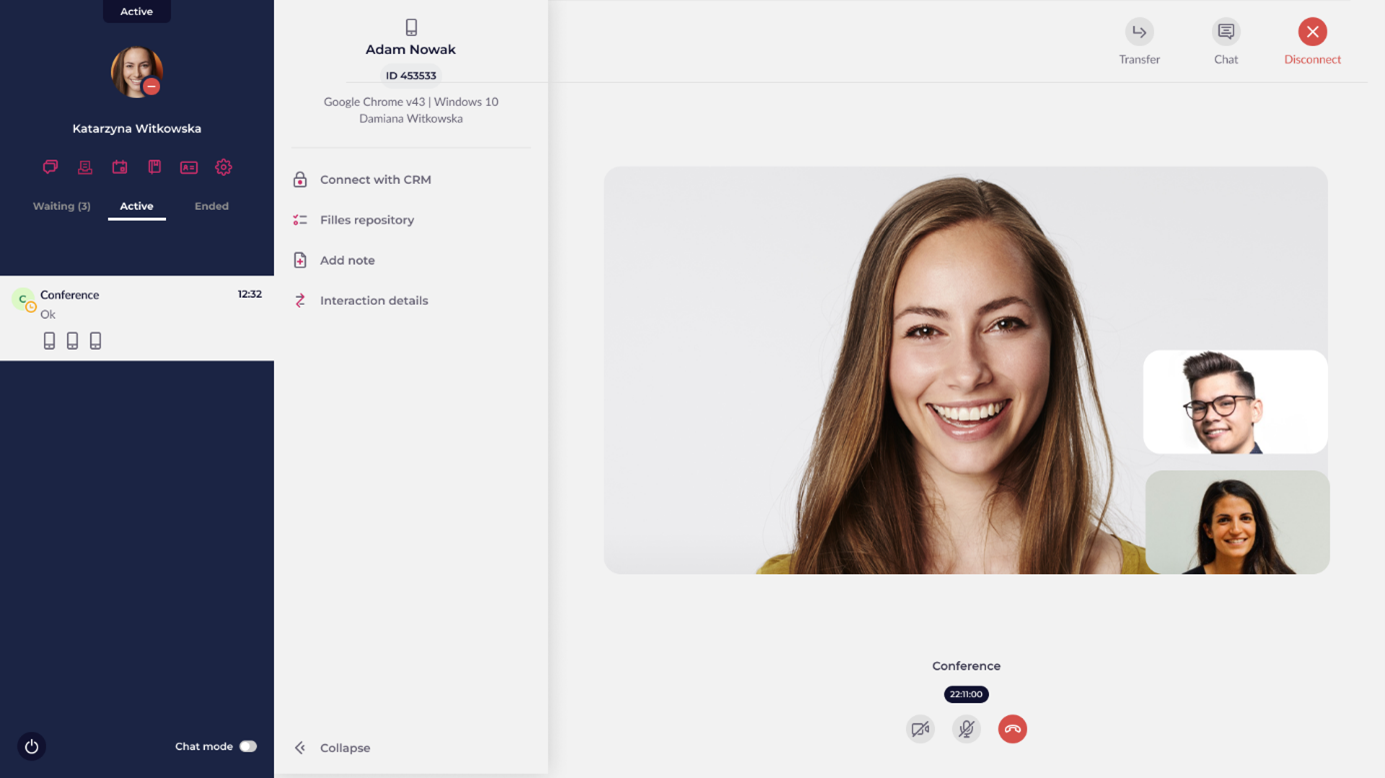

Effective customer relationship management is crucial to building trust and loyalty among customers and building lasting relationships based on mutual trust and understanding. Financial institutions must constantly improve their offers and processes to remain attractive to SME customers. One of the pillars here is communication via video channels. Thanks to the possibility of meeting in a virtual office, we retain the advantages of a face-to-face meeting with all the facilities such as the ability to present, for example, documents directly on the client’s screen and instant document exchange. On the other hand, we save the time needed to travel to the client or the client to us. LiveBank offers unique functionality that improves SME and Corporate customers’ experience – Virtual meetings. Thanks to integration with financial institutions websites allow for quick and easy meeting arrangements. This process is initiated either proactively by agents or by the clients themselves. A kind of extension of the idea of a video meeting is the multi-conference feature which secures the need of a meeting for a larger group of , which ensure a meeting in a larger group. During the call, the advisor can use the screen sharing feature to help visualize the materials. Thanks to this, the interaction closely resembles a face-to-face conversation. Check more:

Improving, streamlining – and costs reduction through digital innovation in banking

The imperative to constantly enhance and streamline processes is central to business evolution, aiming to boost operational efficiency and curtail operating expenses. Incorporating modern tools like conversational artificial intelligence, live chat, and other digital banking functionalities into SME banking solutions and corporate banking software significantly uplifts staff efficiency and slashes operational costs. By equipping employees with the precise knowledge exactly when needed, every minute saved in service time not only elevates customer satisfaction by providing quicker answers to their inquiries but also represents a strategic alignment with the goals of SME banking and solutions for corporate banking. This integration of digital solutions for corporate banking and SME banking software underlines a commitment to innovation, driving forward the modernization of banking services for small and medium enterprises and corporations alike.