Digital mortgage solution for experience-changing of banking technology

Scale up your mortgage operations with 100% remote lending

No need to visit bank branches with fully remote home lending journey

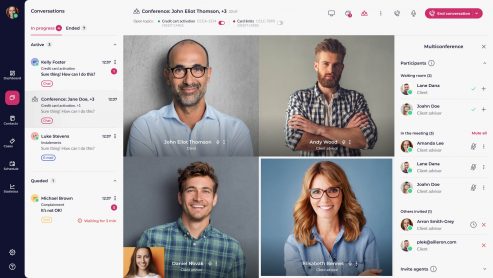

LiveBank Customer Engagement Center for Digital Mortgages

Easy to deploy Cloud-based platform designed with banking standards in mind. Confirmed by implementation at ING Bank.

Attract Mortgage Customers with our Platform

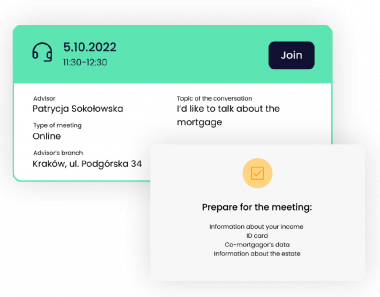

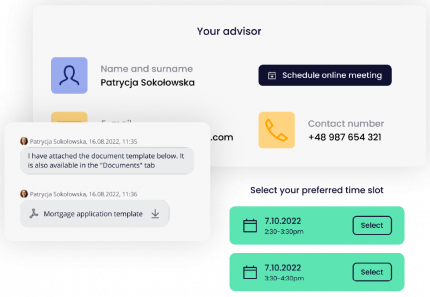

Use a remote approach to attract potential borrowers and successfully convert them into loan applications.

Engage

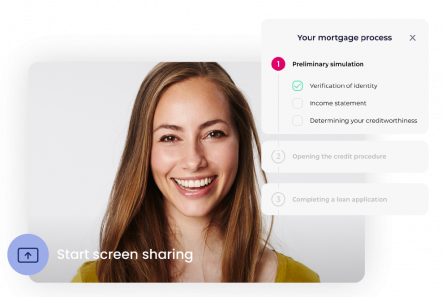

Enable advisor-assisted communication throughout the process to engage your borrowers in their home lending journey.

Apply

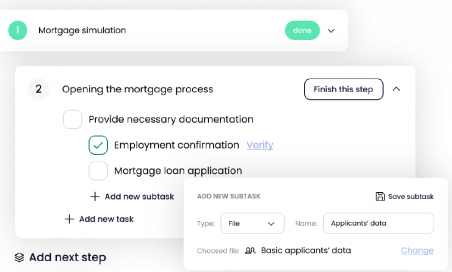

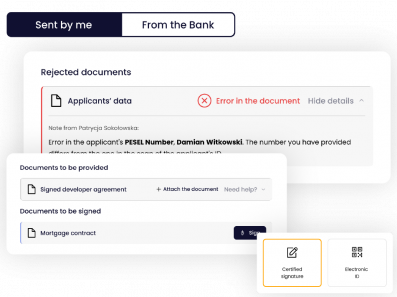

To reduce loan application timeframe, utilise automated processes, integrated collaboration tools, and easily attainable advisor support.

Close

Provide digital closing services with e-signing so borrowers can complete their paperwork without visiting a branch.

Fully remote end-to-end mortgage process with LiveBank

Dive into effortless mortgage journeys

Witness the transformation of the mortgage process into a fully remote, end-to-end solution powered by LiveBank. Explore the seamless integration of technology that simplifies every step of the mortgage journey, offering clients a convenient and efficient experience from start to finish. LiveBank for mortgage is confirmed by successful implementation at ING Bank, where clients are already benefiting from our easy-to-deploy cloud-based platform designed with banking standards in mind.

-

Optimized mortgage origination

-

Dispersed teams empowered

-

Secure and compliant platform

Test our solution or contact us to find out how LiveBank can help you