Transform your contact centre into the centre of excellence

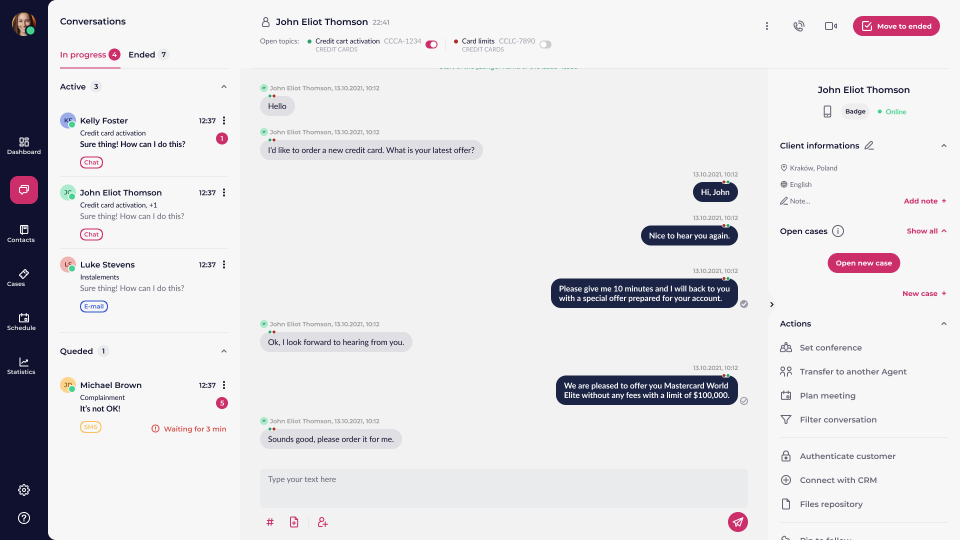

Communication is the key to success in customer support. LiveBank is a smart communication hub for instant and secure communication in digital channels for both existing and prospective clients.

Communication

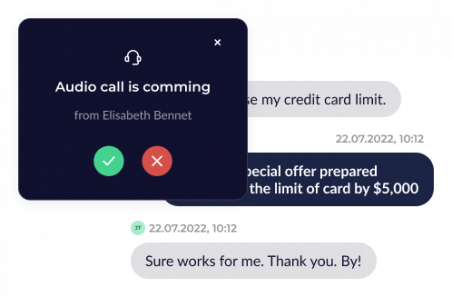

Ensure convenient access to digital banking with a human touch and handle your clients’ matters in communication channels of their choice.

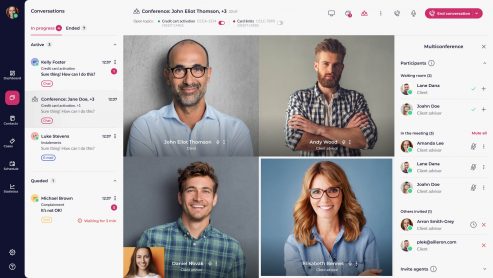

Collaboration tools

Efficient collaboration with a client is one of the main factors that accelerate banking procedures and increase the number of successfully resolved cases.

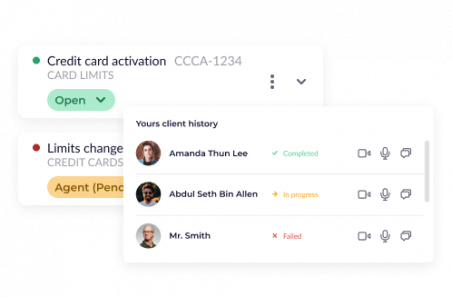

Smart routing

Smart routing based on fully configurable logic ensures fast and efficient resolution of client issues. The call is routed to the currently available agent specialized in the given topic. This solution makes it possible to transfer cases between agents along with all the necessary information.

Integrations

Integrate banking systems and communication channels to offer efficient customer support. The one-point integration approach is a simple solution that guarantees reliable and time-efficient service.

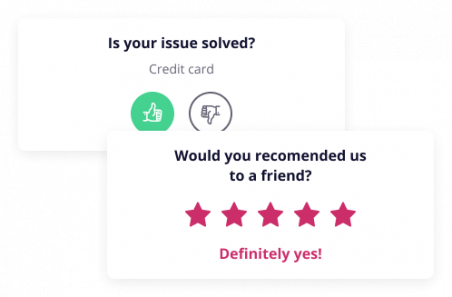

Analytics and reporting

The reporting module compiles data from the entire system and generates analyses, reports, and charts that help monitor employee performance, customer support quality and more.

Our clients say it best

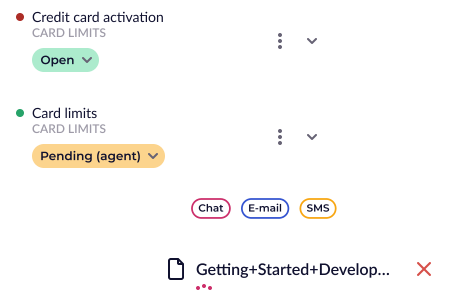

Case-based management

Effective case management allows to open new cases and track the progress. It also facilitates the information flow and increases the efficiency of processes.

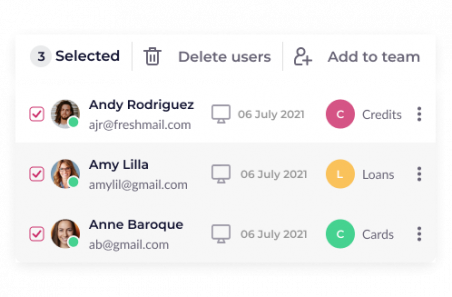

Agent work optimisation

Optimise agents’ work by empowering them with an overview of processes and tools to automate or facilitate routine activities.

Test our solution or contact us to find out how LiveBank can help you