LiveBank

benefits

Keep a client in mind

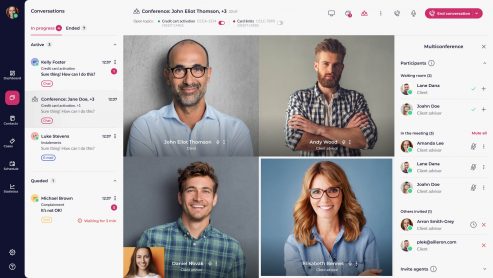

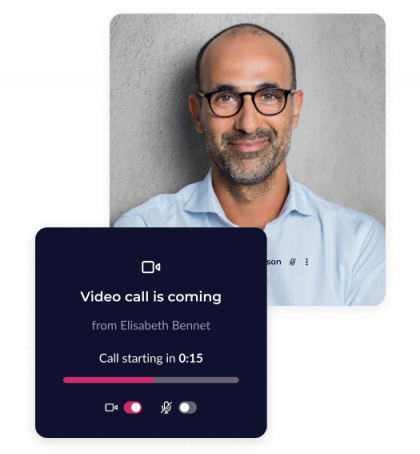

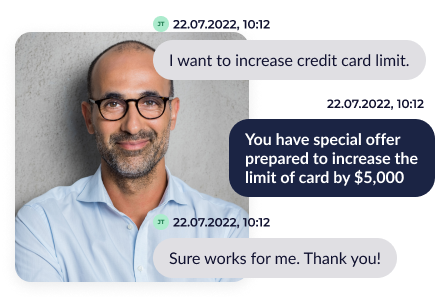

LiveBank facilitates a smooth and safe client migration to digital channels by embedding customer support functionalities like audio and video calls, a chat, and messaging apps in e-banking to enable immediate contact. Routing to an expert agent, collaboration tools such as screen-sharing or co-browsing support digital end-to-end processes, and eKYC streamlines client onboarding.

Keep a client in mindPlug and play

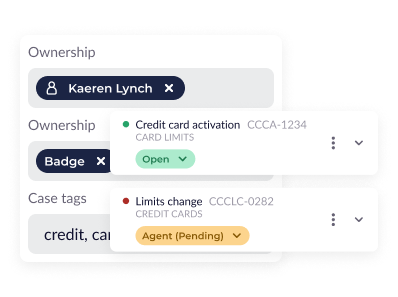

LiveBank ensures a quick one-point integration of digital and traditional customer touchpoints with various back-end banking systems such as CRMs, databases, or file repositories and enables aggregation of dispersed client information and communication history.

Plug and playScale the system as you go

In a dynamic financial services environment, responsiveness to changes and needs is essential. LiveBank provides the flexibility of scaling. You may effortlessly add or cancel licences depending on the number of agents you need at the given moment. You can also introduce new features or integrate more communication channels over time.

Scale the system as you goSolve your problems with LiveBank

How to make digital banking friendly to all clients?

Customise your digital banking experience and embrace inclusivity by providing for all client needs.

How to effectively digitise banking processes?

The success of digitisation depends on how well it serves clients and helps bank employees generate revenue.

How to use additional customer support channels to improve digital banking?

To make e-banking friendly and ensure that processes end in conversion, adopt a journey-based approach to customer experience.

-

Customer satisfaction

enhanced NPS, CSAT, CES indicators

-

System friendliness

higher ratings for online banking

-

Smooth migration to digital

increased number of active

e-banking users

Our clients say it best

Test our solution or contact us to find out how LiveBank can help you