Manage a multi-generation customer life cycle with an optichannel banking communication hub

LiveBank

optichannel banking solution

benefits

Bridge different touchpoints

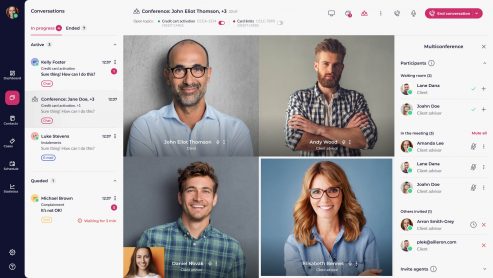

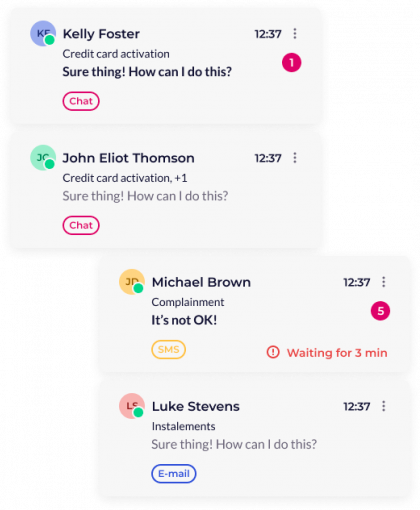

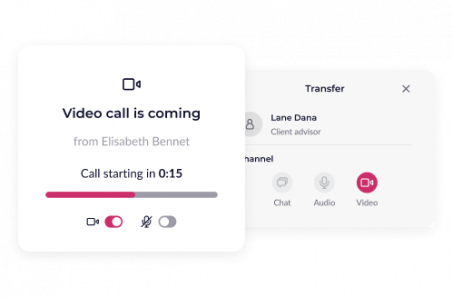

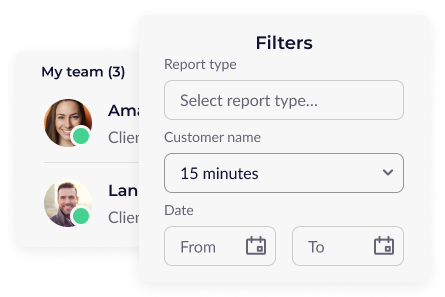

Adding new channels and developing a client communication path in line with your bank’s business objectives has never been easier. LiveBank is a hub that enables seamless communication across channels to maximise the benefits of their specific capabilities and enhance the convenience of remote banking.

Bridge different touchpointsOne-point integration

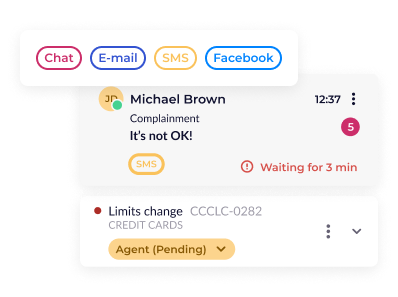

Technology must be user-friendly and serve clients irrespective of their tech-savviness or preferences in terms of devices and type of interaction. LiveBank integrates channels, such as audio or video calls, chat, email, text message, and messaging apps to provide a frictionless end-to-end service.

One-point integrationEnhance the customer experience

The loyalty of your bank’s clients depends on their satisfaction with the service. Create an excellent customer experience using a case-based communication approach and LiveBank functions such as routing to an expert agent, single sign-on, or biometrics. A happy client is more likely to recommend your bank’s services to others, which means higher NPS.

Enhance the customer experienceSolve your problems with LiveBank’s optichannel banking solution

How to ensure continuity of digital banking processes across the channels?

Eliminate the problem of dispersed communication channels and enable contextualised customer support.

How to realise end-to-end processes using different communication channels?

Aggregate contact channels into one omnichannel that supports end-to-end processes.

How to optimise the costs of implementing and maintaining multiple support channels in banking?

Supporting many communication channels does not mean high implementation and maintenance costs.

-

Client retention

89% of clients are loyal to banks that implement an omnichannel strategy

-

Meeting clients’ needs

51% of clients are not satisfied with the current form of communication with their banks

-

Convenience

80% of people prefer online banking over visiting a physical branch

Our clients say it best

Test our solution or contact us to find out how LiveBank can help you