IT solution for banking transformation under the highest security standards

LiveBank

IT banking solution

benefits

Ensure full security

LiveBank meets stringent banking security standards and ensures adherence to the law thanks to encrypted connections, integrated antivirus software, safe database architecture, and state-of-the-art technologies for secure biometric authentication.

Ensure full securityReduce digitalisation costs

LiveBank helps banks adapt to the current technological trends and optimise costs. The SaaS subscription pricing model means low entry costs, while cloud-based service eliminates the costs of IT infrastructure maintenance and upgrades. It is an enterprise-class solution that meets banking security standards.

Reduce digitalisation costsUse a strong tech stack

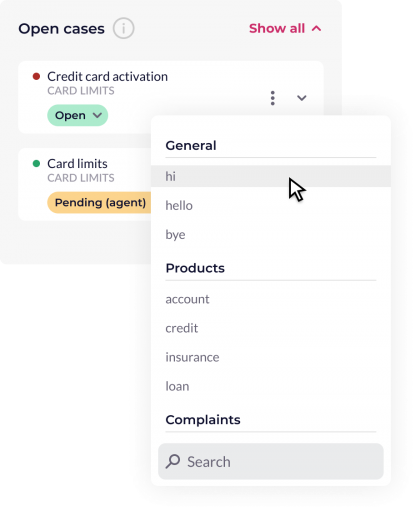

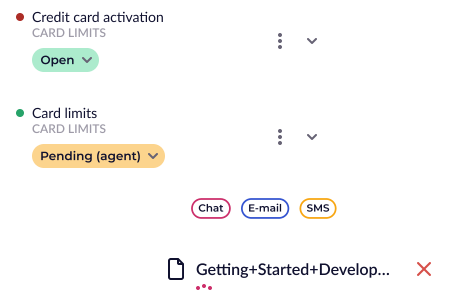

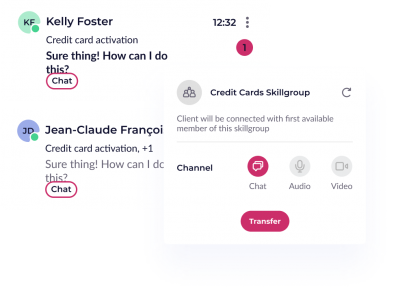

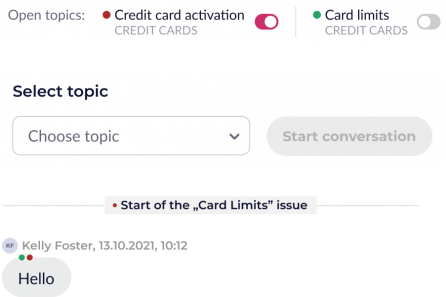

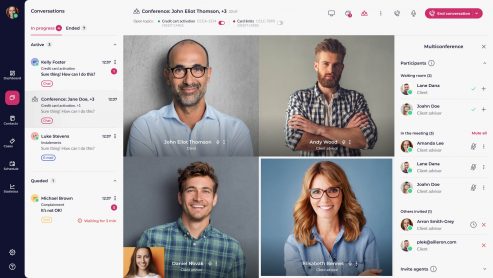

LiveBank benefits from dozens of highly advanced components from the latest technology stack. Adaptive streaming technology which adjusts the audio and video quality to a client’s bandwidth ensures a stable connection and a more satisfying interaction. Asynchronous chat and the function of restoring a broken connection allow maintaining the continuity of communication.

Use a strong tech stackSolve your problems with LiveBank

How to manage IT infrastructure and optimise costs?

Reduce infrastructure and the need for large teams when implementing new value-adding features and capabilities.

How to flexibly adapt IT solutions to business objectives?

Make technology a competitive advantage and unlock new revenue models and services tied to business priorities.

How to avoid system fragmentation and integrate new components in compliance with banking security standards?

Consolidate the system through the centralised deployment of interconnected software components.

-

Direction of change

60% of banks plan on increasing investment in cloud solutions

-

Security

0 security incidents in LiveBank infrastructure in the last 8 years

-

Savings

10% of IT budgets are spent on security development – reduce this cost with LiveBank

Our clients say it best

Test our solution or contact us to find out how LiveBank can help you

Embrace Security with Our Cloud Banking Solution

We use the best IT technology for the banking sector, including cloud. As a result, when opting for a digital transformation with us, you can be sure that all your data is as secure as possible. Why LiveBank?

Firstly, we have seen zero security incidents in the past eight years in LiveBank. This is perfect proof that we use the best IT technology for banking.

Secondly, by integrating your data into our platform, you don’t have to worry about the implementation of security measures for your other banking products – the data is stored in our cloud. This means that you can reduce the overall costs of developing your cybersecurity, knowing that we will be protecting your data effectively.

Easy Integration to Help You Cut Costs

What distinguishes our IT products for banking is that they can be easily integrated into your IT infrastructure. Due to the one-point integration, the process is extremely easy and gives you excessive flexibility – you may test new solutions emerging from the fintech world with ease. Make IT your strong side, and adopt our tech solutions!

Looking for Cloud Banking Technology? Pick LiveBank

Cloud technology is becoming increasingly popular in fintech, and we understand that. Our LiveBank has been operating using it from the start. This gave us the opportunity to polish our tech, including encryption and data transfer methods, ensuring that our cloud solutions are both efficient and secure.

By selecting LiveBank, you opt for quality, experience, regular updates, and scalability. Our IT technology for banking will help you embrace Industry 4.0 and gain an edge over your competitors. So, do not hesitate – contact us and learn more about our banking solutions!