Capitalize on opportunities in banking sales solutions and convert prospects in a frictionless process

Enhance availability of banking products, support end-to-end processes, foster a proactive approach to sales, and generate cross-selling opportunities with LiveBank.

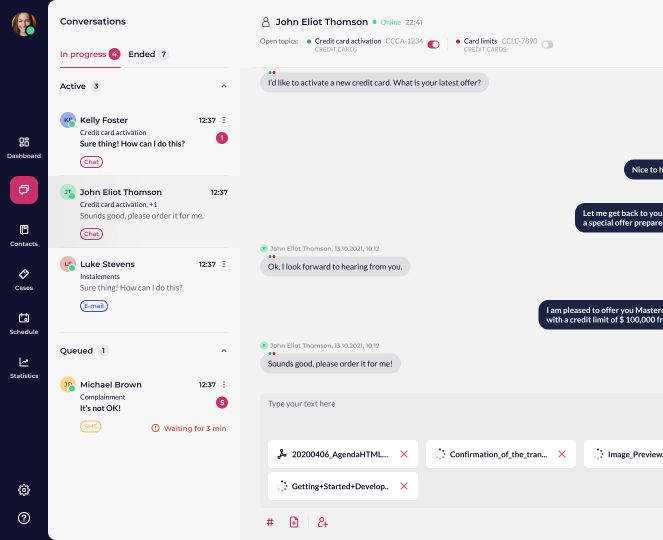

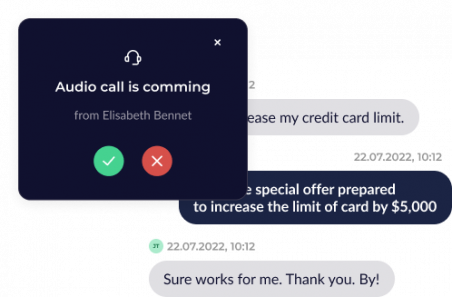

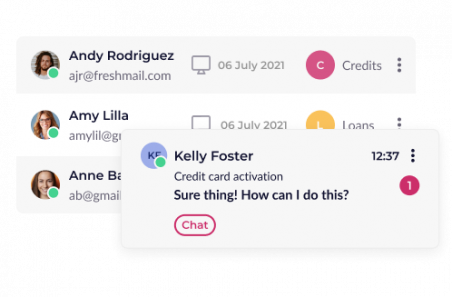

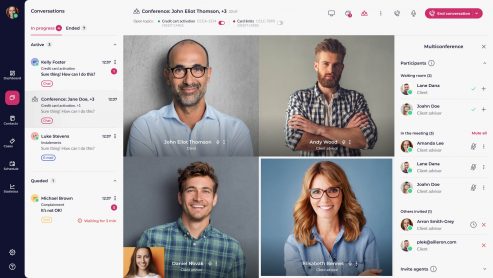

Chat, audio & video

Realize the full potential of digital banking by providing human assistance at appropriate points in the process to close a deal in a single interaction.

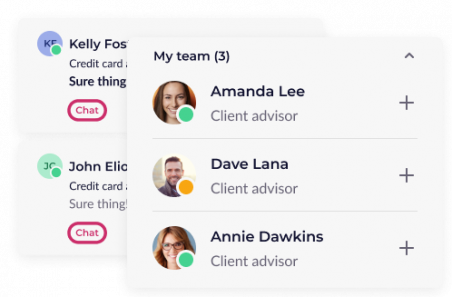

Collaboration tools for banking sales

Efficient collaboration with a client is one of the main factors that accelerate banking procedures and increase the number of successfully resolved cases.

Secure remote work environment

Ensure the security of your customers’ data and a risk-free work environment for agents

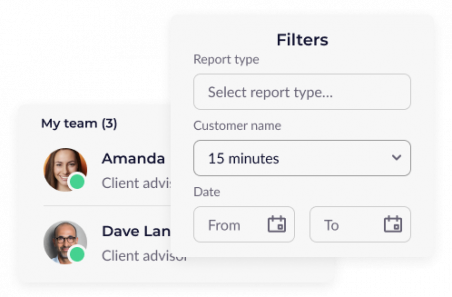

Work management

Empower your sales force, coordinate workflow, and manage operations to help your agents achieve or even surpass sales targets.

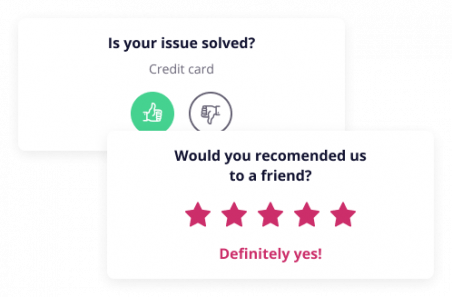

Our clients say it best

Online onboarding

Support the sales of banking products in digital channels with minimal assistance from sales agents.

For more information,

go to the eKYC page

Test our solution or contact us to find out how LiveBank can help you

Sales Support for Banking Products – Driving Your Revenue Growth

Do you measure missed sales opportunities? Do you know how many of them there are each year and how much income you’re missing out on due to this phenomenon? What if we told you that you can avoid it? How? With our sales support for banking products available on the LiveBank platform.

Our digital banking solution will help you boost sales and close a higher number of leads, but also acquire new sales opportunities. How?

Intelligent Product RecommendationsLiveBank comes with AI that is capable of preparing product recommendations based on each client’s data. As such, it provides sales support for your digital banking products by opening new opportunities. |

Data Integration and AnalyticsLiveBank integrates data from all the systems and uses AI to analyze it. As a result, it can find patterns in customer behavior and generate predictions – for instance, locate leads that you are about to miss out on – giving you time to react. |

Streamlined communicationLiveBank also comes with robust communication features, including file exchange, graphical tools, screen sharing, and more. Thanks to them, your sales team can streamline communication with the clients and make it more convenient (enabling the use of digital channels), building customer satisfaction. At the same time, all our solutions are secure – you won’t have to worry about data leaks. |

Enhanced Sales Team ManagementLiveBank sales support modules for digital banking products enable you to manage all the sales processes and statistics. As a result, you get a full overview of the team’s performance. What is more, it enables you to locate potential bottlenecks more quickly and eliminate them, ensuring that your team will close more leads in the future. |