The end of 2025 marks the end of a strategic chapter for many financial institutions. Something is coming to an end, but it also opens space for defining new directions. It is rare for the entire market to face such a clear, simultaneous need to recalibrate its course – yet this is exactly where banks in Poland and across Europe find themselves today, planning where they want to be in the next five, or even ten years.

Strategies published by Poland’s UniCredit, ING, BNP Paribas, and mBank offer both benchmarks and inspiration. A closer look shows that banking is entering a phase of digital maturity. The conversation is no longer about digitising processes, but about building new service models that combine the power of artificial intelligence (AI), the scalability of the cloud, and automation with the authenticity of human-to-human interaction. This is a response to rising market pressures: intense fintech competition, a fast-moving regulatory landscape, cost optimisation requirements, and customer expectations around personalisation, availability, and transparency. Today, the ability to deliver excellent customer experiences and to do so quickly is what truly differentiates institutions.

The line between what banks traditionally offer and what fintechs offer is fading rapidly. Customers want the convenience and simplicity they associate with fintechs, while fintechs increasingly apply for full banking licences.

At the same time, banks are adopting technologies that enable fast, secure, and more personal customer service. Conversational platforms such as LiveBank are becoming natural components of modern omnichannel strategies, integrating chat, video, and remote processes into a unified ecosystem, available anytime. They prove that it is possible to move at fintech-like speed while preserving a bank’s heritage and trust.

Table of Contents

Banking Directions for 2026 and Beyond: Faster, Smarter, More Customer-Centric

Banking-as-a-Service is no longer the domain of visionary startups – it’s becoming a cornerstone of strategies at major institutions. In many cases, it is simply easier to deploy a ready-made solution than to build one from scratch. UniCredit is a strong example: a robust API layer, scalable cloud infrastructure, and a “platform-based” architecture that allows partners to consume banking services quickly and reliably.

The accelerating pace of technological innovation, growing operational complexity, increased automation, and ongoing pressure to reduce operating costs create substantial challenges for every institution. A telling example of the need for flexibility is our recent migration project with Standard Chartered Bank, where we moved LiveBank to a new data centre and upgraded all core environment components. As a result, the entire architecture gained the ability to expand freely with new functionalities, access the latest technologies, and achieve full cloud readiness. The outcome? The organisation now manages deployments across markets from a single, clear dashboard and grows at a pace set by business needs, not by technical constraints.

This is why cloud migration and microservices architecture should be top priorities – they provide both flexibility and scalability. The Banking-as-a-Service (BaaS) model enables institutions to deliver ready-made solutions to fintechs (e.g., accounts, payment APIs, card services), increasing scale and diversifying revenue streams.

In practice, the bank of 2026:

- offers fintechs modular banking services like digital building blocks,

- monetises data and infrastructure (in line with regulations),

- develops business relationships beyond the traditional banking sphere,

- builds competitive advantage through products and, equally, through integration capabilities.

From our perspective, digital conversational channels fit this trend naturally. LiveBank has been designed from the outset to meet the regulatory and operational standards of the financial sector. We enable banks, lending companies, fintechs, leasing firms, and marketplace platforms to use complete sales and service processes without building them from the ground up. Conversational layers are becoming the new interaction fabric: a foundation on which new business models grow, no longer tied to physical branches but defined by access anytime, anywhere.

The Rise of AI-Driven Banking: From Workflow Automation to Real-Time Risk Analysis

The first institutions have already paved the way, making AI-powered solutions available not only to internal teams but also directly to customers. These technologies have moved far beyond buzzword status – they now deliver tangible value, from risk analysis and customer service to product development and even coding. Regulations such as the AI Act are attempting to keep up, setting a framework for this rapidly evolving reality.

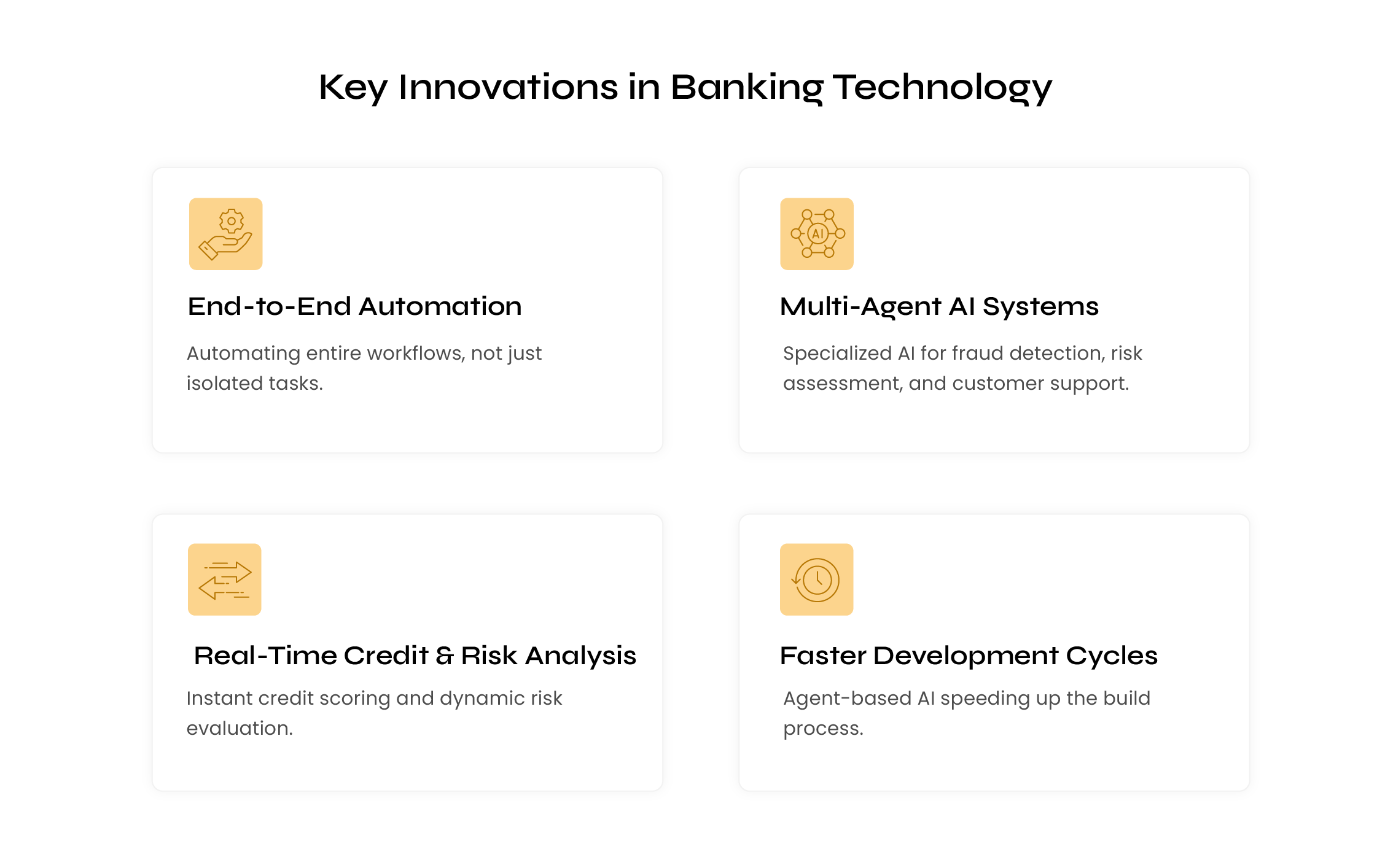

Across the industry, the most significant developments are happening in:

- automation, which now spans entire workflows rather than isolated processes,

- multi-agent AI systems, each highly specialised (e.g., risk assessment, fraud detection, customer support), taking over repetitive operational tasks,

- real-time credit scoring and risk analysis,

- accelerated development cycles, with agent-based AI platforms performing large parts of the build process.

All of this requires a transformation of the technological backbone: cloud infrastructure, API layers, real-time data, but also a shift in the operating model. Banks are discovering that AI is not just a tool; it is a co-worker that can cut manual effort by tens of percentage points, deliver rapid analytics, and generate content. The real challenge is no longer building AI agents, but orchestrating their interactions and collaboration. Gartner estimates that AI-native platforms will reduce development teams by 80% by 2030 and will reshape the very philosophy of software creation. This goes far beyond coding: it changes how organisations work while requiring full regulatory control. How accurate these forecasts prove to be will be tested in the coming years.

LiveBank is at the forefront of this shift, blending automation with human expertise. Solutions already available on the platform, such as AI Summary, AI Prompter, and AI Chatbots, create a unified journey in which the customer:

- begins with an AI agent,

- transitions seamlessly to a human advisor,

- and completes the process via video, including real-time signature and KYC.

This model balances two key requirements in this sector: cost optimisation and high customer satisfaction. Maintaining that balance will be difficult without conversational channels – they’re becoming the new meeting point between customers and banks.

Operational Efficiency as a Strategic Priority in Banking

Regulatory pressure, rising technology costs, ESG requirements, and growing cyber risks make operational efficiency as fundamental to banks as their lending offer. For years, the sector has been shifting toward centralised operations, automation, and a gradual departure from traditional branch-based models. Financial institutions now operate in an environment where every decision must simultaneously:

- reduce costs,

- strengthen resilience,

- improve service quality,

- enhance security and compliance.

At the same time, the nature of threats is evolving. Fraud volumes are growing at double-digit rates each year, with global losses already exceeding $1 trillion. Criminals increasingly exploit human behaviour rather than system vulnerabilities – hence the declining effectiveness of classic phishing e-mails and the growing prevalence of personalised attacks, such as SMS messages about alleged delivery surcharges. This behaviour-driven fraud model is particularly dangerous because it bypasses core infrastructure safeguards.

In this context, banks must view their operations not through the lens of individual products or transactions, but through the full customer lifecycle. That lifecycle becomes the organising principle for service models, risk policies, and the interaction ecosystem.

Financial institutions, therefore, need to focus even more strongly on long-term customer relationships – from early financial steps, through career development, home purchases and savings, to investment management, wealth transfer and succession planning. At every stage, banks hold rich zero-party and first-party data. In practice, this means the need to:

- design product portfolios around the customer’s life path – from current accounts to savings, investments, and wealth advisory,

- apply demographic and behavioural segmentation to tailor messages, offers, and channels to the specific moment the customer is in.

Banking in 2026: Key Takeaways for Financial Institutions

The financial sector enters 2026 with the understanding that digital is no longer a direction – it’s the natural environment in which banks operate. The key question is no longer “Should we invest in technology?” but rather “How do we use it wisely to strengthen stability, security, and the customer experience?”

Banks face the challenge of combining three worlds: AI infrastructure, security architecture, and rising customer expectations. This is not about disruption; it’s about thoughtfully scaling solutions that were innovative only recently and are now becoming foundational. Strategies published by ING, mBank, and BNP Paribas all point in the same direction: full channel integration, accelerated AI adoption, and a decisive improvement in operational efficiency. And across all these documents, one message resonates clearly – the future belongs to banking that “moves at the customer’s pace.”

Those who recognise that customer trust is built not only through technology, but also through transparency, availability, and meaningful human interaction, will come out ahead.

From this very blend emerges a key trend that, in our view, will define the sector in 2026: human-centred service in a digital world. Banking is no longer about completing a few transfers in an app, because that’s already the baseline. Customers expect to handle financial processes remotely while still benefiting from the advisory value of a real conversation.

Industry events like IT@BANK confirm that 2026 will be a year of practical, tangible technology adoption. Banks are no longer looking to deploy “yet another tool.” They want to solve real operational challenges: reduce service costs, optimise branch networks, streamline processes, meet regulatory requirements, and maintain high service quality at the same time.

In this context, LiveBank is not a communication system. It’s an answer to a more fundamental question: How do we preserve advisory relationships in a world where physical branches are becoming a rarity?