Digital transformation in financial institutions is an ongoing journey rather than a one-time project. Core system replacements often span years, all while banks must operate without interruption and cannot afford downtime. Could anyone imagine halting banking operations even for an hour – let alone for weeks? In such circumstances, every technological decision becomes a strategic move – much like a chess game. Each step must be carefully considered, adaptable, and aligned with the broader vision.

One of the most common questions we hear is: Should LiveBank function as a standalone platform with optional integrations, or as a deeply integrated component within an existing ecosystem such as Salesforce?

The answer depends on institutional strategy, infrastructure, available resources, and appetite for innovation. See how Citi implemented Livebank in Hong Kong and Singapore. Both approaches are valid, but they serve different needs. Below we present their characteristics, advantages, and implications for financial institutions (such as banks, lending companies, and leasing companies).

Table of Contents

Two Paths to Implementation of LiveBank

Just like a coin has two sides, LiveBank can be deployed in two distinct but equally powerful ways:

- LiveBank as a standalone platform – quick start, minimal complications. Integrations can be delivered over time.

- LiveBank as an integrated component (e.g. with Salesforce) – deep context, automation, and scalability.

Standalone Approach – Ideal for Those Who Want to Get Started Quickly

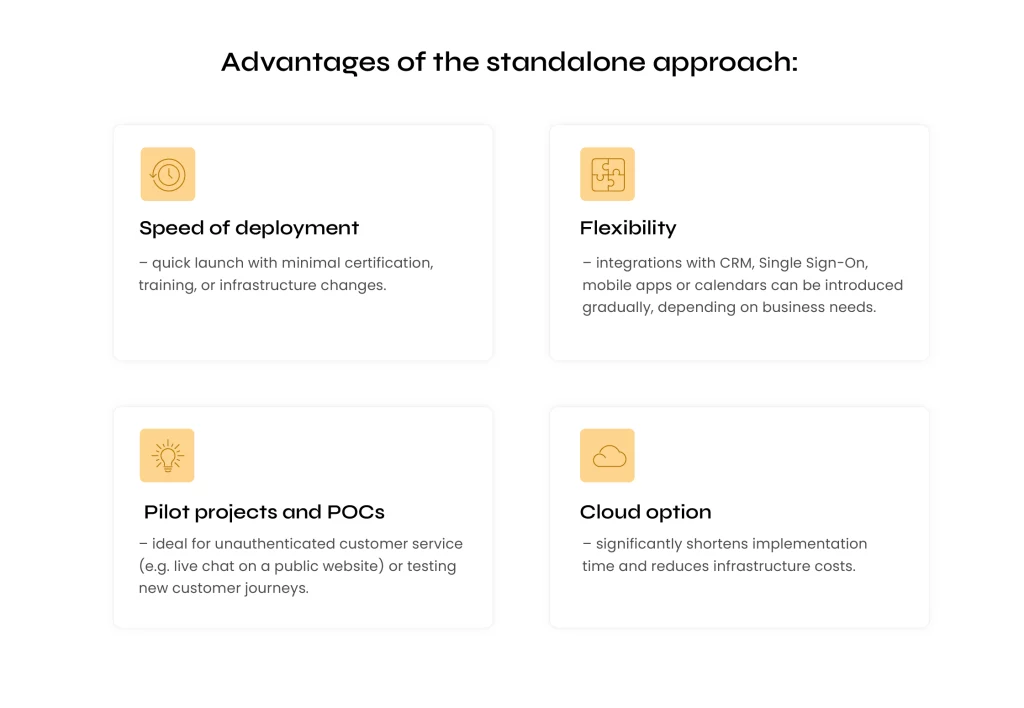

One of the most common implementation strategies is to deploy LiveBank as a fully independent solution. In this model, the platform works as a separate application, instantly enabling modern customer communication without the need for extensive IT projects. This means configuration flexibility.

This approach works particularly well for unauthenticated customer service, such as web chat, as well as for pilot or proof-of-concept (POC) projects where banks want to test functionality or customer journeys. It requires only minimal organizational involvement—limited to certification, network access, and training – but in practice, the appetite for additional capabilities quickly grows, from calendar integration and Single Sign-On to embedding in mobile applications. Another advantage is the option to use LiveBank in a cloud model, which significantly shortens implementation time and reduces infrastructure costs. Most importantly, it provides a safe way to validate ROI at an early stage: institutions can deploy rapidly, demonstrate value, and plan deeper integrations based on real usage data.

The standalone approach is a good choice for organizations that want to see business value quickly and open a modern communication channel without changing the whole IT system. A fast launch makes it possible to check ROI, test how customers react, and plan more integration later. This way, financial institutions can start fast, get clear results, and then add new features step by step – exactly when they are needed.

Salesforce + LiveBank = A Partnership Built for the Future

Salesforce is more than just a CRM – it’s a platform designed to support the full spectrum of customer engagement. When combined with LiveBank, it creates an environment where every interaction is more than problem-solving, it becomes an opportunity to build lasting relationships.

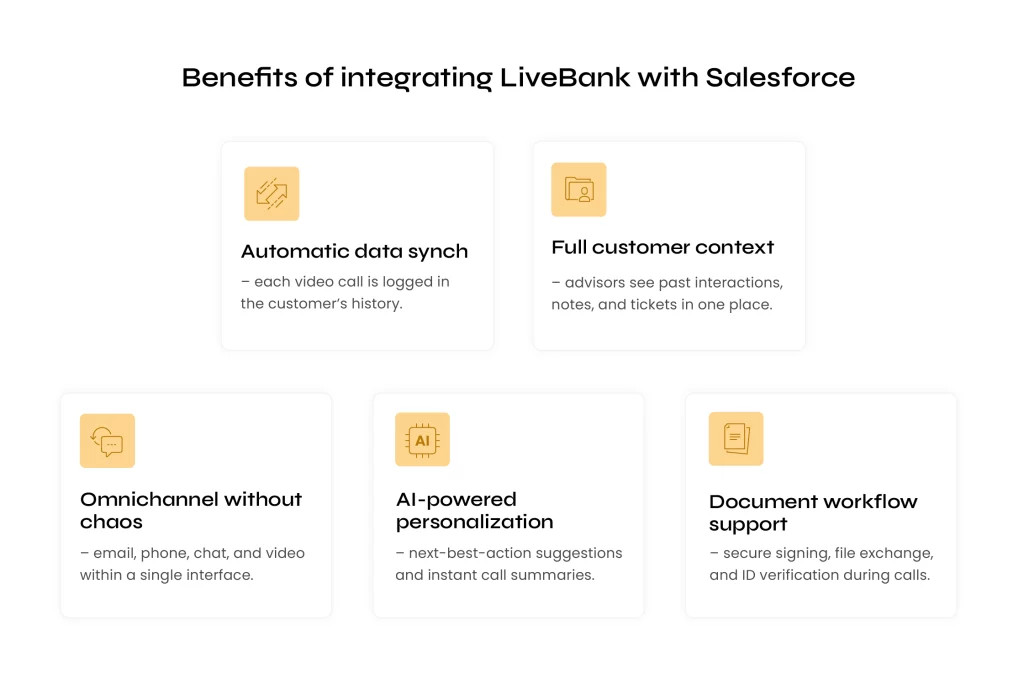

Integrating LiveBank with Salesforce offers a range of benefits:

- Automatic data synchronization – each video call is logged directly in the customer’s history, reducing manual reporting.

- Full customer context – advisors see past contacts, notes, and tickets in one place, enabling quick and precise action.

- Actual omnichannel – email, phone, chat, and video all in a single window, without the need to switch between applications.

- AI-driven personalization – suggestions for the following best action and automatic conversation summaries.

- Document workflows and onboarding tools – secure signing, file exchange, and identity verification during calls.

The Advisor in Salesforce Sees More And Faster

Thanks to integration with Salesforce, LiveBank is not a separate tool but a natural extension of the advisor’s daily workspace. Shared context, interaction history, automatic record synchronization, and the ability for immediate follow-up create an environment where advisors can act more quickly, effectively, and with greater confidence.

Connecting via video with a customer? Just one click. The advisor sees a preview from the client’s camera, and if more LiveBank features are needed, the window can be expanded instantly. Now they have access to customer data, recording history, shared files, notes, and planned actions.

In practice, this means eliminating time-consuming processes of logging in to several systems or searching for data in separate repositories. It’s not just a meeting. It’s a full-value advisory session with smart assistance.

For financial institutions focused on delivering high-quality customer service and operational agility, this is more than just integration – it’s a shift in the operating paradigm.

One Salesforce – Multiple Channels

The integrated use of LiveBank and Salesforce enables seamless operation across multiple communication channels: video, phone, email, chat – all in one environment. The client sends an email, and the advisor initiates a video call – without losing context or switching systems. Everything is stitched into a seamless customer journey.

Furthermore, customer data can be updated in real-time: if a new need arises during the conversation, the advisor can immediately add a note, assign the client to a campaign, or schedule a follow-up—all within the same system.

This smooth operation translates directly into shorter turnaround times, better customer experience, and higher FCR (First Contact Resolution).

Automation That Actually Works

With calendar integration, the advisor can easily schedule meetings, and the system assigns context (sales, service, or thematic). Meeting? Logged. History? Archived. Follow-up tasks? Ready to go.

Furthermore, access to video recordings and the complete contact history facilitates reflection and continuity of service, even if the advisor changes. The customer’s context remains intact, and trust is enhanced.

Adding AI-powered analytics and KPI dashboards provides team leaders and customer experience executives with a clear view of performance and trends across all channels. Salesforce offers a powerful suite of omnichannel, automation, and knowledge management tools. When integrated with LiveBank, advisors can work within a unified environment.

ROI – That Speaks for Itself

According to Forrester’s Total Economic Impact (TEI) study for LiveBank can save up to 20% of advisor time spent on system navigation. This means less switching apps, more time for real interaction. This directly translates into higher service levels, larger portfolios, and faster case resolution.

Moreover, the analysis of implementation projects shows a reduction in time-to-market of new services by up to 30%, which has a direct impact on the competitive advantage.

Which Path Is Right for You?

Deciding whether LiveBank should operate as a standalone platform or as part of a CRM ecosystem such as Salesforce is not a question of “better or worse.” It is a matter of organizational priorities:

- If the goal is speed and flexibility, a standalone deployment ensures quick results and gradual expansion.

- If the focus is on deep integration, automation, and long-term scalability, embedding LiveBank into Salesforce unlocks the full potential of the advisor’s workspace.

No matter the chosen approach – standalone or integrated – LiveBank remains at the heart of modern digital communication with customers. It’s up to the organization whether this central function operates independently or in harmony with its entire CRM ecosystem.

In both cases, the customer is always at the center. And that’s what truly matters.