When the time comes to talk to a customer service representative, who is often working under pressure to resolve issues according to strict time targets, customers anticipate seamless and enjoyable experiences. Customers not only seek an immediate response, which is always a plus, but more often, issues arise because customers try to solve more complex problems that require more than one conversation, one contact, or even one communication channel. Many cases require comprehensive support, which means customers interact with multiple contacts in different departments.

To solve the challenges that service teams face, we’re proud to introduce the Case-Based Communication mechanism in LiveBank, which also supports other functions in the system. Thanks to this solution, all of the information from interactions triggered by messages, video/audio calls, files, and more, is included in the client case. Representatives, advisors and supervisors can easily find all of this information in one optiichannel communication hub dedicated to the specific query or based on the customer’s history.

This helps bank advisors become orientated with each client’s situation faster, which also boosts customer service and efficient communication, regardless of which customer service agent or advisor is involved. For example, imagine a situation when one client’s usual advisor is on vacation. The Case-Based Communication mechanism allows another advisor to step in and take care of the client, as they will have access to comprehensive information on that client’s case. LiveBank also has a tool that helps to monitor agents’ work, measuring their effectiveness, creating a base for reports, and helps model processes. With these capabilities, analysing the customer experience and implementing improvements in work processes are much easier.

- Prioritise tasks more efficiently

- Decide on the order of routing

- Increase consultant efficiency

Thus, the system allows consultants and customer service agents to organise their work better and resolve cases more efficiently, thanks to the improved prioritisation of tasks and accounts. At the same time, supervisors can continue to assign tasks to their agents.

Are you wondering what the customer service path looks like on the example of a loan inquiry? Here’s how it works:

The client requests to speak with a customer service representative through the chat feature of the website. From the technical side, the information about the case and the topic of the conversation have been already included in the case’s properties.

- The client requests to speak with a customer service representative through the chat feature of the website. From the technical side, the information about the case and the topic of the conversation have been already included in the case’s properties.

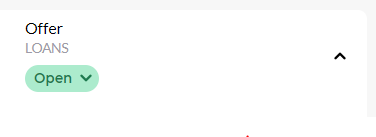

- The case, including all interactions with the client thus far, along with a description of what is likely to be the case and a subject, are sent to the advisor. The case appears on the advisor’s dashboard with an “Open” status.

- The advisor serves the client using, among other things, the quick response function dedicated to the relevant type of issue. In this case, the issue type is “Loans”.

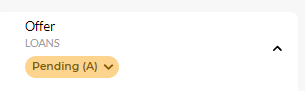

- The client asks the advisor to prepare a dedicated loan offer. However, the advisor needs some time to prepare all the materials and send them. The agent promises to deliver the materials the next day. The agent changes the case status to indicate that his action is required (“Pending (A)” status).

- The next day at work, the advisor checks the hub for issues that are still open on his TO-DO list — issues that require his attention. There, he finds the loan offer task.

- Once the materials are prepared, the consultant sends a follow-up chat message to the client attaching everything the client had requested. After that, the advisor changes the case status to “Pending (C)” to indicate that the case is awaiting the client’s response.

- After reviewing the answer, the client sends a reply to the advisor. Because the original agent assigned to the case is not available, the message is immediately sent to another advisor from the Customer Service Department. The new advisor can review the entire conversation and case history, and she can quickly take over the case.

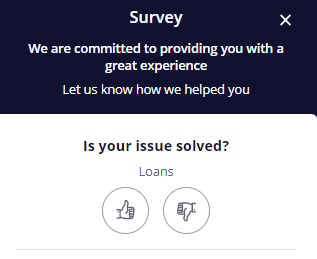

- Finally, our new advisor can focus on solving the task at hand rather than deciphering scattered information. She successfully closes the case. Then the client receives a dedicated survey to gauge their satisfaction with the case.

In the LiveBank solution, we provide a case module adapted to the role (e.g., advisor, supervisor) of the employee in the organisation. A total view of all historical conversations with customers in our module makes it easier for all bank teams to complete their work. Remember that all activities (messages, video/audio calls, files) are swiftly assigned to their relevant cases. Moreover, if a particular case involves more than one connection with one or more representatives, its entire history is available for your bank teams to see. Our hub allows representatives to quickly recover information associated with a particular case and allows supervisors to verify the accuracy and quality of the information provided by agents.

This is just one example of how you can take advantage of Case-Based Communications. We hope you like our solution, but we are always open to feedback and inspiration from our partners to constantly improve our products.

If you’d like to see Case-Based Communications in action, contact one of our representatives today.